Warren Buffett’s recent decision to further reduce Berkshire Hathaway’s stake in Apple raises several pivotal questions regarding investment strategy and market behavior. For four consecutive quarters, the renowned investor has steadily downsized his holding in the tech giant, capturing both attention and speculation within the financial community. As of the end of September, Berkshire Hathaway reportedly held $69.9 billion in Apple shares, signifying a substantial offloading of approximately 300 million shares—nearly 67.2% lower than the same time last year. The sustained divestment from a position that had once embodied confidence in the technological sector prompts a thorough examination of motives and implications.

Buffett originally delved into Apple’s stock in 2016, a surprising move given his historical aversion to technology companies, which he deemed outside his “circle of competence.” His investment team, led by Ted Weschler and Todd Combs, catalyzed the shift, correlating Apple’s reputation for strong customer loyalty and the robustness of its iPhone ecosystem. Buffett’s passion for the brand turned what was once a substantial investment into Berkshire’s most significant equity holding. However, a notable pivot occurred starting in the fourth quarter of 2022, escalating during the second quarter of 2023 when Buffett sold nearly half of his stake. This drastic action raises eyebrows—what has changed to cause such a pivotal adjustment?

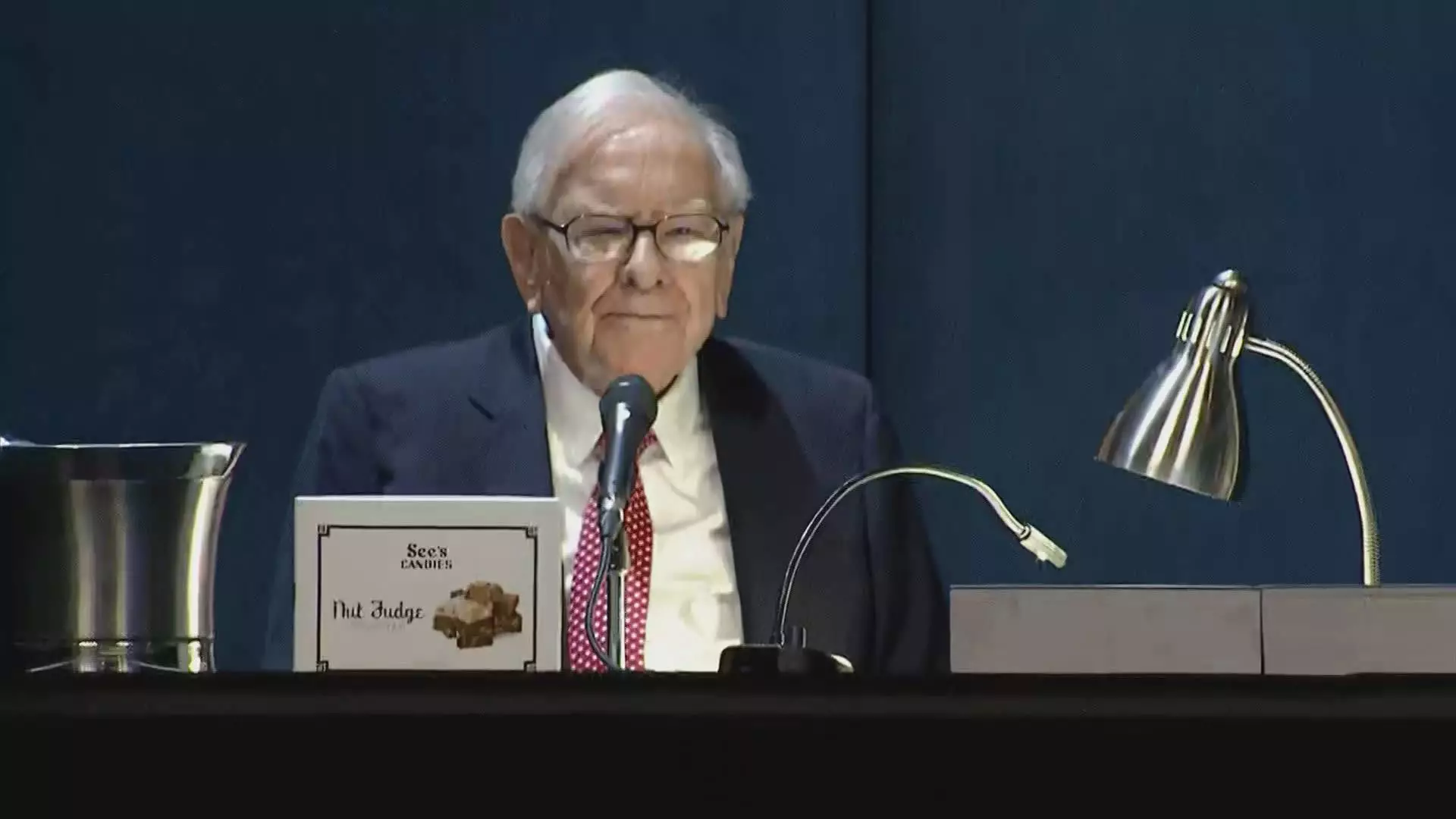

At Berkshire’s annual meeting in May, Buffett hinted that potential increases in capital gains taxes could have influenced his selling spree. As the U.S. grapples with fiscal policy and a climbing deficit, the fear of unfavorable tax laws could have propelled his decision to liquidate substantial assets. However, many analysts suggest this reasoning may not solely account for the sheer magnitude of sales. The moves made by Buffett appear more calculated, indicating a strategic endeavor to mitigate risks associated with portfolio concentration. When one segment dominates a portfolio—like Apple once did for Berkshire—diversification becomes essential to safeguarding against market volatility.

Apple has demonstrated resilience, with shares climbing 16% year-to-date, albeit lagging behind the S&P 500’s 20% gain. This performance juxtaposes with Buffett’s withdrawal, suggesting a divergence between market confidence and Berkshire’s internal adjustment strategies. Importantly, during this selling period, Berkshire’s cash reserves have surged to an astounding $325.2 billion, strikingly illustrating the conglomerate’s cautious stance amidst fluctuating market dynamics. The pause in buybacks further exemplifies a strategic pivot, focusing on building cash reserves rather than reinvesting in its historically preferred tech stock.

Buffett’s recent actions showcase an evolving investment philosophy characterized by prudence and adaptability. This shift may well serve as a reminder to investors about the necessity of reassessing their positions in changing market landscapes. While Berkshire Hathaway’s confident stride into technology continues to leave an imprint, the relentless selling of Apple shares suggests a conscious effort to balance risk and reward, pointing toward a future where strategic fluidity may become increasingly crucial. As the market evolves, so too must the strategies of even the most seasoned investors.