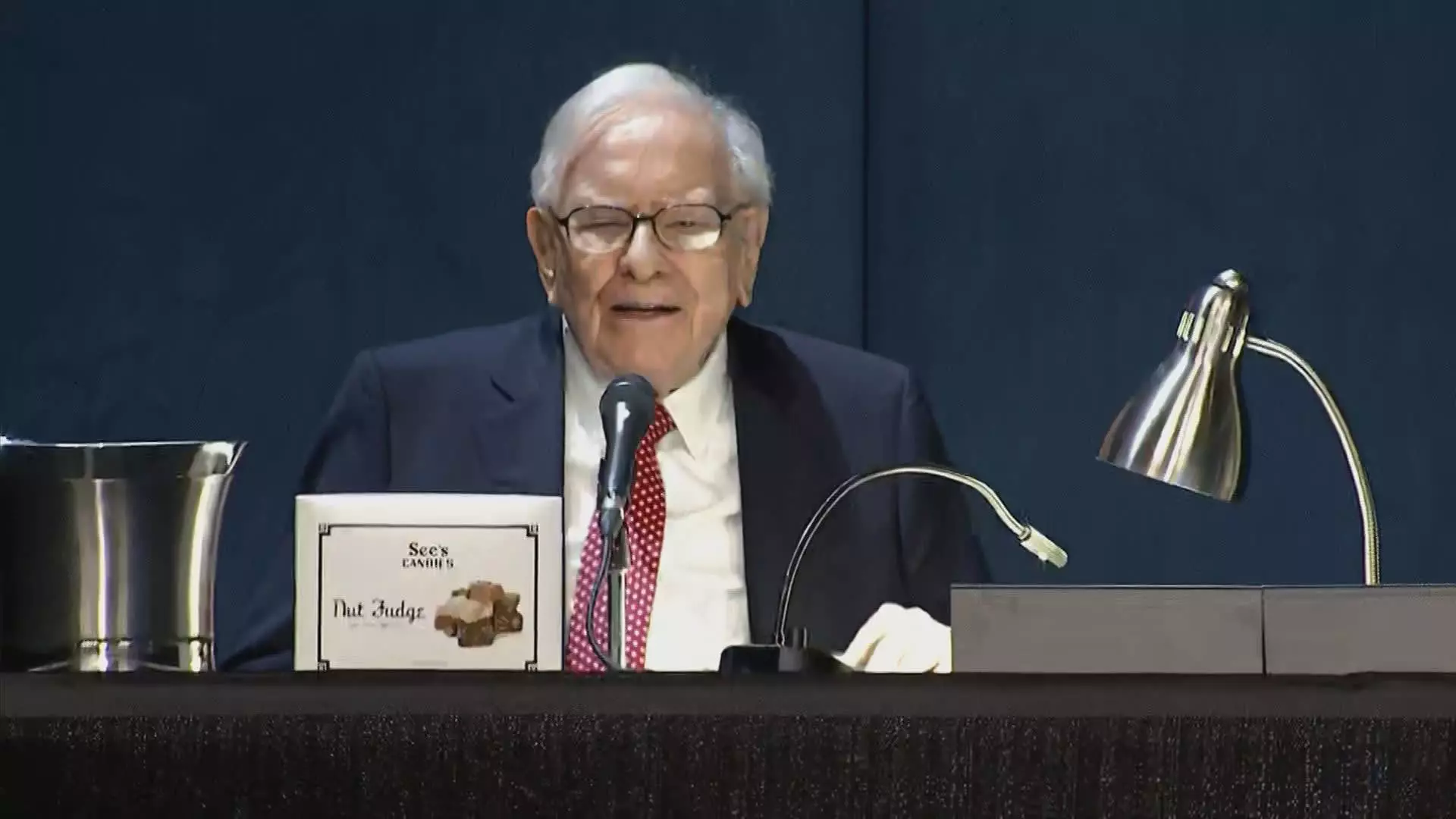

In a surprising move, Warren Buffett’s Berkshire Hathaway has once again offloaded a significant portion of its Bank of America shares. This recent round of sales brings the total amount divested to over $7 billion since mid-July, resulting in a reduced stake of 11% in the company. The conglomerate sold a total of 5.8 million BofA shares in separate transactions, totaling almost $228.7 million at an average selling price of $39.45 per share. This series of sales marks the continuation of Berkshire’s selling streak, spanning 12 consecutive sessions similar to the period between July 17 and August 1.

As a result of these substantial divestments, Bank of America has now slipped to the No.3 spot on Berkshire’s list of top holdings, trailing behind big names like Apple and American Express. Prior to this selling spree, BofA had held the prestigious position of being Berkshire’s second-largest holding. It is worth mentioning that Warren Buffett’s initial investment in BofA dates back to 2011 when he purchased $5 billion worth of the bank’s preferred stock and warrants following the financial crisis. The subsequent conversion of these warrants in 2017 catapulted Berkshire into the position of being the largest shareholder in BofA.

In response to Berkshire’s recent sales, BofA CEO Brian Moynihan made a rare comment acknowledging that he was unaware of Buffett’s motivations for offloading shares. Stressing that the market was absorbing the stock and that BofA was repurchasing a portion of the shares, Moynihan insisted that life would go on despite Berkshire’s reduced stake in the company. The CEO expressed gratitude towards Buffett for his shrewd investment back in 2011, which played a crucial role in stabilizing the bank during a challenging period.

Despite the recent divestments by Berkshire Hathaway, shares of Bank of America have only experienced a minor 1% decline since the beginning of July. With the stock up by 16.7% this year, it has managed to outperform the S&P 500 index. Moynihan highlighted the lucrative nature of Buffett’s investment by referencing the low share price of $5.50 at the time of his initial purchase, contrasting it with the current trading price of nearly $40 per share. He commended Buffett for his bold moves in stock acquisition, emphasizing the impressive returns he has reaped from his investment in BofA.

Warren Buffett’s ongoing trimming of Bank of America shares underscores the ever-evolving nature of Berkshire Hathaway’s investment strategy. Despite holding a substantial stake in the company for several years, Buffett’s recent actions indicate a shift in priorities within the conglomerate’s diverse portfolio. As market dynamics continue to fluctuate, only time will tell how this latest development affects both Berkshire Hathaway and Bank of America in the long run.