The Swiss Franc (CHF) has recently demonstrated a notable appreciation against the euro, attracting attention as a safe-haven currency amid rising political tensions in the Eurozone. Investors often flock to the CHF during periods of instability, recalling its historical role as a financial safeguard. However, this surge raises critical questions about the potential implications for Switzerland’s export-driven economy, which heavily depends on its trading relationships within the Eurozone.

The present political climate in Europe, particularly fueled by tensions surrounding the French government’s efforts to implement budget cuts, has exacerbated uncertainty. Left and far-right factions are mobilizing against Prime Minister Michel Barnier, igniting fears of broader instability. Analysts from Bank of America have noted that this backdrop has once again positioned the CHF as an attractive option for those looking to hedge risks, drawing investors anxious about the prospects of a fractious Eurozone.

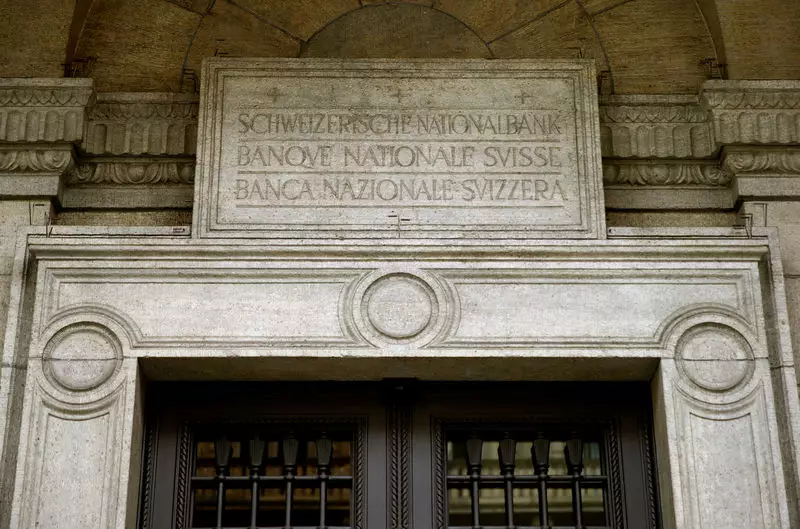

Given that the Eurozone is Switzerland’s largest trading partner, any excessive strength of the CHF relative to the euro could trigger alarms at the Swiss National Bank (SNB). A stronger Swiss Franc may enhance imported goods’ purchasing power but could simultaneously harm Swiss exports as domestically produced goods become more expensive abroad. The SNB, therefore, has a vested interest in managing the CHF’s value to maintain export competitiveness while ensuring economic stability.

Current Market Sentiment and Future Outlook

Despite the evident political challenges in the Eurozone, recent market movements suggest that the appreciation of the CHF may not be as formidable as initially perceived. The Bank of America analysts caution against overestimating the ramifications of recent CHF movements, indicating that the decline in the EUR/CHF exchange rate is likely more influenced by short positioning on the CHF rather than a genuine surge in safe-haven demand. This perspective suggests that the SNB might not need to intervene aggressively at this stage, as the evidence does not strongly indicate a drastic outperformance of the CHF against its G10 peers.

Emailing Out Projections on CHF Performance

Looking to the future, the outlook for the CHF as a safe haven stands firm, especially during fluctuating political climates in the Eurozone. However, as analysts continue to monitor trends, it is essential to recognize that seasonal patterns and existing positioning may muddy the waters. The historical tendency for the EUR/CHF pair to weaken in December could also play a role, suggesting potential short-term fluctuations. Given this complexity, opportunities for bearish CHF positioning against currencies with clearer policy divergences, such as the British pound (GBP) and the U.S. dollar (USD), may offer investors more clarity and potential gains.

While the Swiss Franc remains a favored safe-haven currency amid uncertainty, its strength poses challenges to the export-oriented Swiss economy. As political instability continues to shape market sentiments, the Swiss National Bank’s response will be crucial in navigating this tricky terrain. Investors must stay vigilant of both macroeconomic trends and the political landscape to maximize their strategic positioning in this fluid environment.