The semiconductor industry has been closely monitored in recent years, especially with the rise of China as a key player in the global market. According to a recent report by Bank of America analysts, four of the world’s largest semiconductor equipment manufacturers, including ASML, have experienced a significant increase in their China revenue. Since late 2022, the share of China revenue for these companies has more than doubled, indicating a growing demand for semiconductor manufacturing equipment in the region.

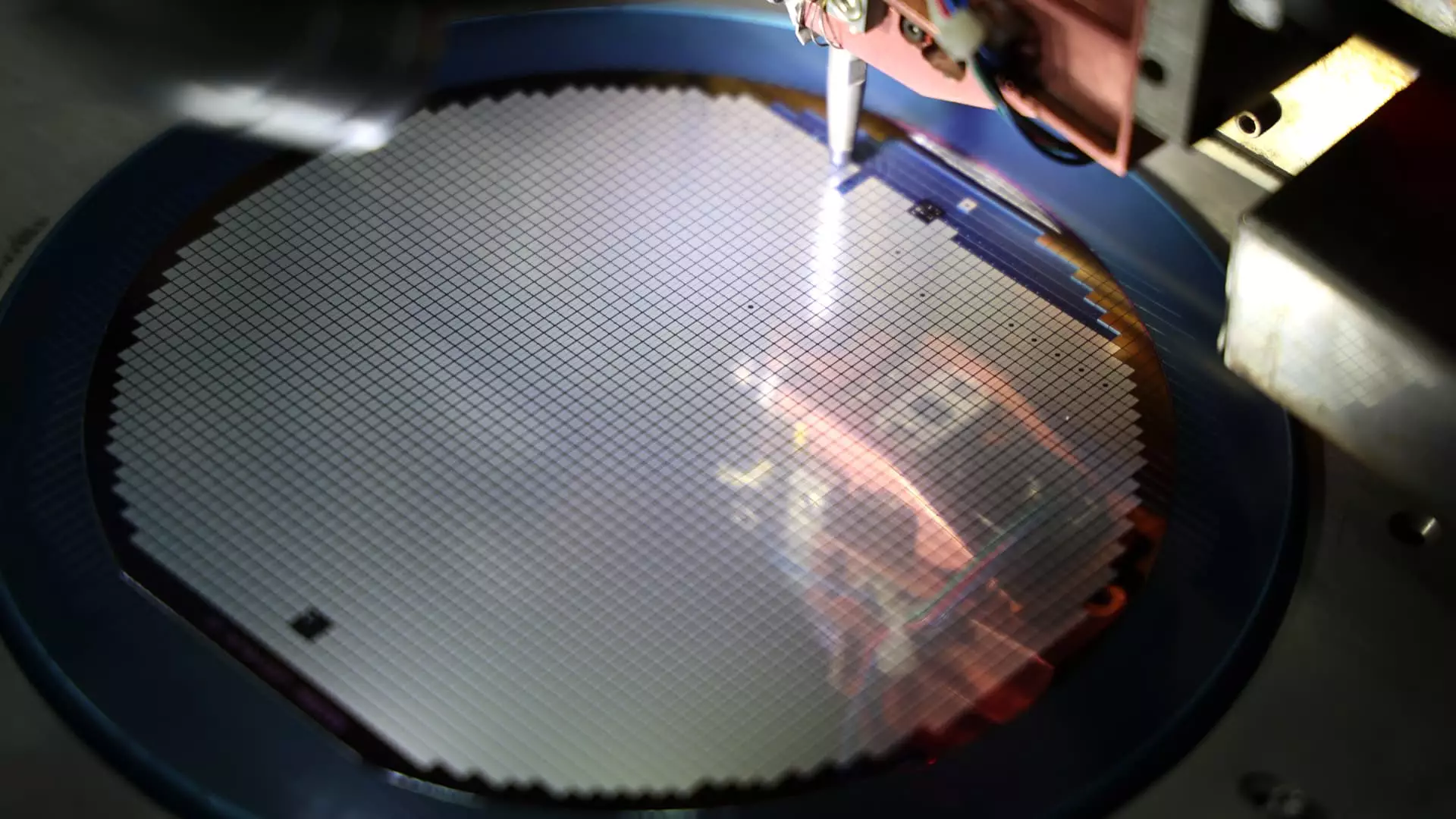

One of the key factors driving this trend is the U.S. imposed tighter export restrictions on advanced semiconductors and related manufacturing equipment to China in October 2022. In response, China accelerated its purchases of semiconductor manufacturing equipment with the goal of developing its own manufacturing capability. This shift in strategy has led to a substantial increase in China revenue for companies like Lam Research, KLA Corp., and Applied Materials, in addition to ASML.

The report also highlighted the importance of the semiconductor industry in trade tensions between the U.S. and China. With tech, particularly semiconductors, at the forefront of these tensions, companies in the industry face potential risks if tensions escalate further. The Biden administration is reportedly considering broader restrictions on semiconductor equipment exports to China, which could impact not only U.S. companies but also non-U.S. manufacturers.

On the other hand, Beijing has been actively working towards enhancing its tech self-sufficiency, as evidenced by recent statements from top leaders reaffirming this goal. By boosting its domestic semiconductor manufacturing capabilities, China aims to reduce its reliance on foreign technology and strengthen its position in the global semiconductor market. This shift in focus is likely to have long-term implications for the industry as a whole.

Despite the uncertainties surrounding trade tensions and export restrictions, the semiconductor market has shown resilience in the face of challenges. The VanEck Semiconductor ETF (SMH), which tracks U.S.-listed chip companies, has experienced fluctuations in recent weeks but still maintains significant gains for the year. As the industry continues to evolve and adapt to changing dynamics, companies will need to navigate complex geopolitical factors and market pressures to stay competitive in the global semiconductor market.