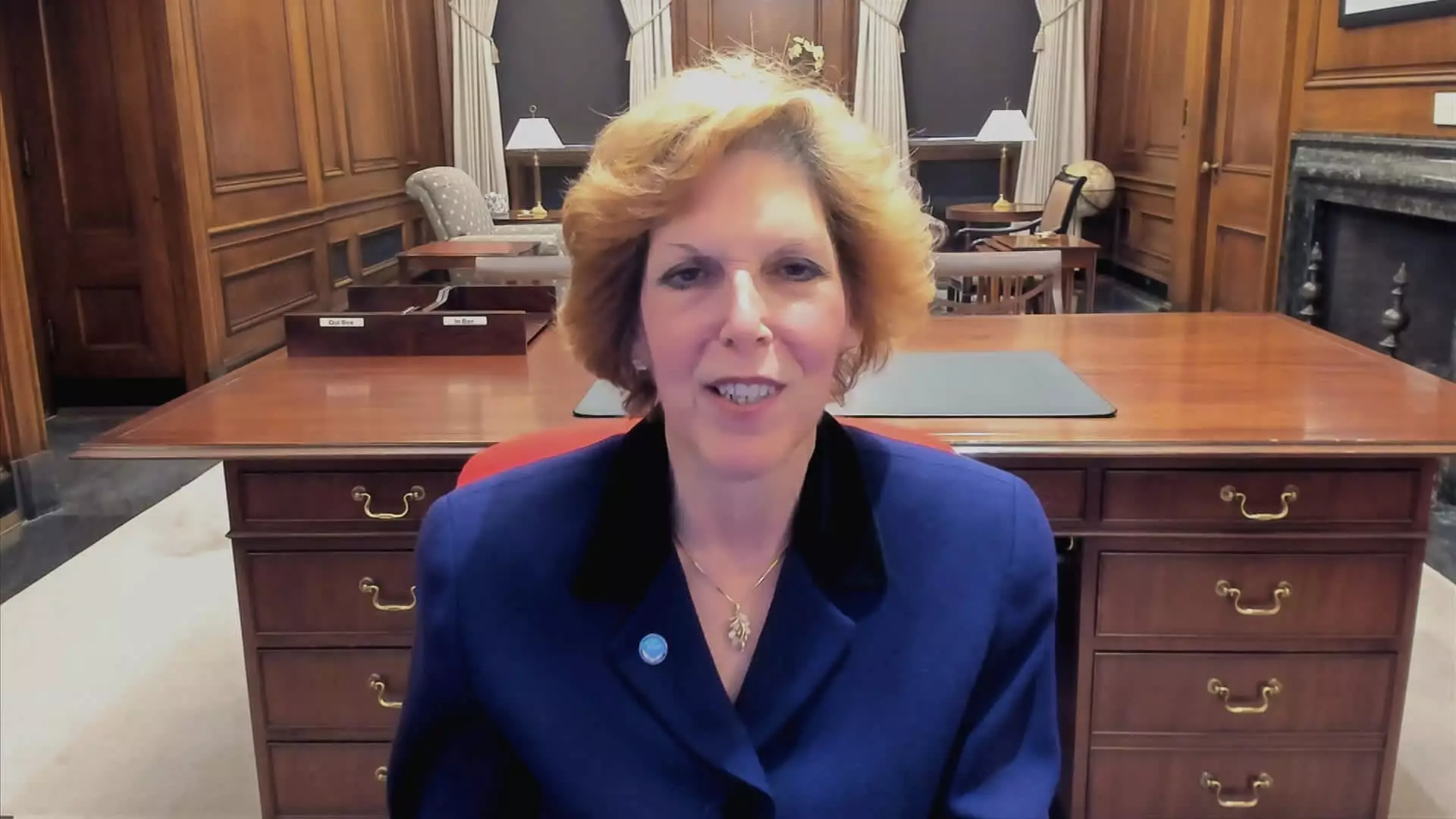

Cleveland Federal Reserve President Loretta Mester recently expressed her belief in the possibility of interest rate cuts occurring within the year. However, she specifically ruled out the upcoming policy meeting in May as a potential timing for such action. Additionally, Mester highlighted that the long-run trajectory is anticipated to be higher than what policymakers had previously anticipated. This stance indicates a cautious approach to implementing rate cuts, based on the need for more conclusive evidence regarding inflation’s stability.

Mester’s counterpart, San Francisco Fed President Mary Daly, shares a similar outlook on the potential for rate cuts in the near future. Daly emphasized the importance of substantial evidence showcasing subdued inflation before considering any adjustments to current rates. She acknowledged the strides made in controlling inflation while also noting the ongoing growth in the economy. While Daly anticipates the likelihood of rate cuts in the scenario of continued progress, she refrained from providing clear guidance on the timing or extent of possible adjustments.

Both Mester and Daly emphasized the significance of data-driven decision-making in determining the appropriate course of action regarding interest rates. Mester highlighted the need for additional inflation data to bolster confidence in the anticipated downward trend towards the 2% target. She noted that upcoming inflation readings would offer valuable insights into distinguishing between temporary fluctuations and potential stagnation in inflation progress. Therefore, a cautious approach is warranted in assessing the broader economic landscape before committing to substantial rate adjustments.

The recent decision by the Federal Open Market Committee (FOMC) to maintain current borrowing rates reflects the sentiments echoed by Mester and Daly regarding the need for more substantial evidence of inflation stability. While market expectations align with a projection of rate cuts in the coming months, the timeline and magnitude of such adjustments remain uncertain. Mester’s impending departure from the FOMC after reaching the 10-year limit underscores the transitional phase in monetary policy decision-making.

In her assessment, Mester identified a deviation from the previously held expectation of a 2.5% federal funds rate in the long run. Instead, she posited a higher estimate of 3% for the neutral or “r*” rate, indicating a level of policy neutrality between restriction and stimulation. The increasing projection of the long-rate rate to 2.6% post-March meeting suggests a divergence in perspectives within the FOMC regarding appropriate interest rate levels. Mester’s recognition of the limited policy flexibility during the Covid pandemic underscores the importance of strategic policy calibration in response to economic developments.

The perspectives of Federal Reserve Presidents Mester and Daly provide valuable insights into the nuanced considerations guiding interest rate decisions. The emphasis on data-driven assessments, cautious projections, and strategic policy calibration underscores the complex decision-making process within the Federal Reserve. As economic conditions continue to evolve, a nuanced approach to monetary policy remains critical in navigating the path towards sustainable economic growth.