China recently released economic data that highlighted a mixed bag of results. Retail sales saw a modest increase of 2.3% in April, falling short of the 3.8% forecasted by a Reuters poll. This sluggish growth was a concerning sign for the consumer side of the economy. On the other hand, industrial production surged by 6.7% in April, surpassing expectations for a 5.5% growth, pointing to robust industrial activity in the country.

Fixed asset investment in China rose by 4.2% in the first four months of the year, lower than the expected 4.6% increase. However, real estate investment took a hit, with a steep decline of 9.8% year-on-year for the same period. This decline in real estate investment, along with a slowdown in infrastructure and manufacturing investment, indicated areas of concern in the Chinese economy.

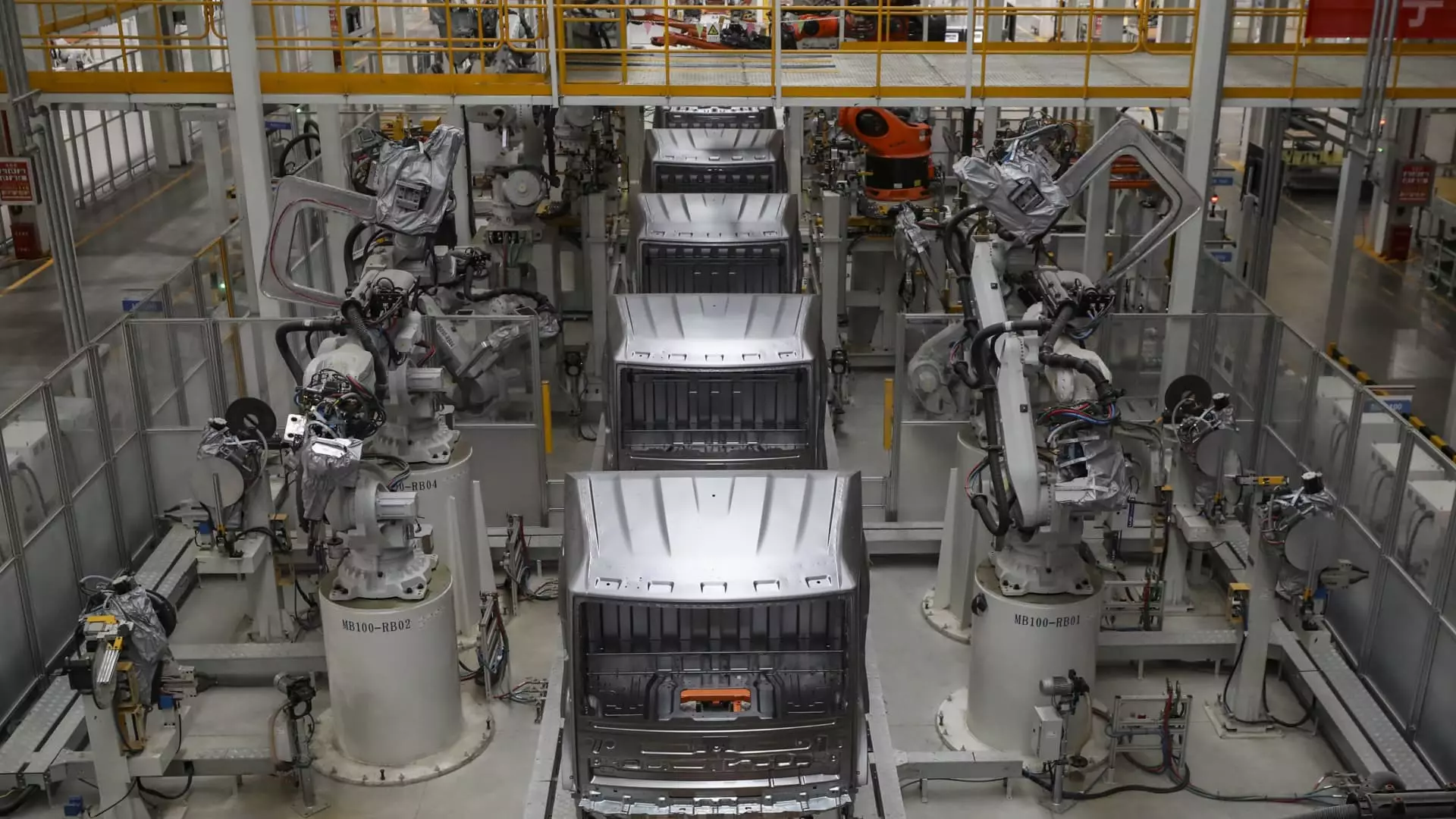

Despite the mixed results in various economic indicators, the urban unemployment rate in China stood at 5% in April. Retail sales, which grew by 6.8% year-on-year during a recent holiday period, showed some signs of improvement. The Ministry of Commerce reported growth in retail sales of home appliances by 7.9% and automobiles by 4.8%, boosted by nationwide incentives.

The April economic figures were affected by the May 1 Labor Day holiday and a high base from the previous year. China also launched a six-month program to issue decades-long bonds to fund strategic projects. While the economic impact of these bonds is expected to be felt in the first half of the following year, it could potentially boost market confidence.

The Chinese economy faces challenges such as a slump in the real estate sector, declining factory prices, and sluggish new loan data. To address these challenges, more cities have eased housing purchase restrictions to bolster sales. Officials from various government bodies are scheduled to hold press conferences to discuss policies aimed at supporting the delivery of homes.

Economists like Dan Wang from Hang Seng Bank (China) anticipate the stabilization of China’s property market by the end of next year. Despite the challenges in the real estate sector, Wang believes that the Chinese economy has shown resilience, with industrial investment and manufacturing compensating for losses in the housing market. The Chinese government aims for around 5% GDP growth in 2024, with experts suggesting that increased domestic demand is crucial for sustained economic growth.

China’s economic data paints a complex picture of both challenges and opportunities. While retail sales show some improvement, the real estate sector and declining investment pose significant concerns. The government’s policy responses and the resilience of the industrial sector will play a crucial role in steering the Chinese economy towards sustainable growth.