In August, China’s Consumer Price Index (CPI) rose by 0.6% on an annual basis, slightly higher than the market expectation of 0.7%. This inflation data has important implications for the Australian Dollar (AUD) due to the strong economic ties between Australia and China.

One of the key factors affecting the value of the Australian Dollar is the level of interest rates set by the Reserve Bank of Australia (RBA). The RBA plays a crucial role in adjusting interest rates to maintain stable inflation rates between 2-3%. Higher interest rates compared to other major central banks can support the AUD, while lower rates may have a negative impact on the currency.

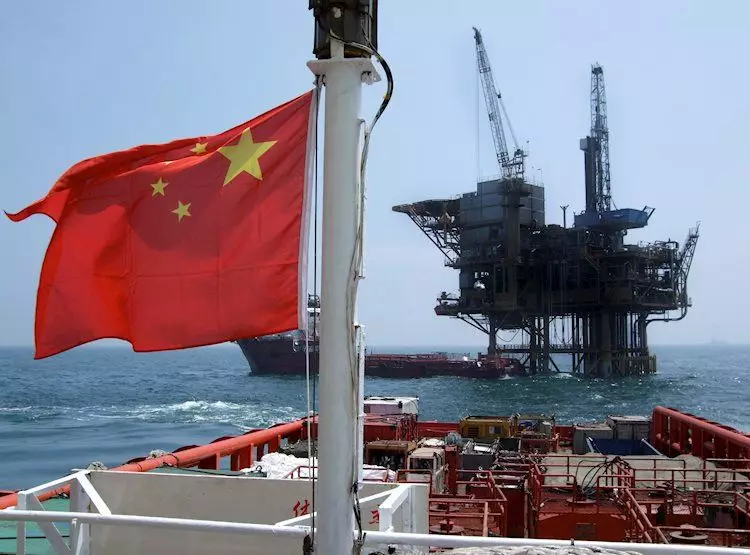

Impact of Chinese Economy on AUD

As China is Australia’s largest trading partner, the health of the Chinese economy directly influences the value of the Australian Dollar. When the Chinese economy is thriving, it increases its demand for Australian exports, boosting the demand for the AUD. Conversely, a slowdown in the Chinese economy can lead to a decrease in the value of the Australian Dollar.

Iron Ore is Australia’s major export commodity, with China being the primary destination for exports. Changes in the price of Iron Ore can significantly impact the value of the Australian Dollar. Higher Iron Ore prices generally lead to an increase in the value of the AUD, as it indicates higher demand for Australian exports.

The Trade Balance, which represents the difference between a country’s exports and imports, also plays a crucial role in determining the value of the Australian Dollar. A positive Trade Balance, where exports exceed imports, can strengthen the AUD as it reflects strong demand for Australian goods and services.

Market sentiment, particularly the risk-on behavior of investors, can also influence the value of the Australian Dollar. When investors are inclined towards riskier assets, it can have a positive impact on the AUD. Similarly, positive or negative surprises in Chinese economic data can directly impact the Australian Dollar and its exchange rates.

China’s economic data, including inflation rates, producer price index, and overall economic health, have a significant impact on the value of the Australian Dollar. Factors such as interest rates, trade balance, Iron Ore prices, and market sentiment all play a crucial role in determining the strength of the AUD in relation to the Chinese economy. Investors and traders closely monitor these economic indicators to make informed decisions regarding the Australian Dollar.