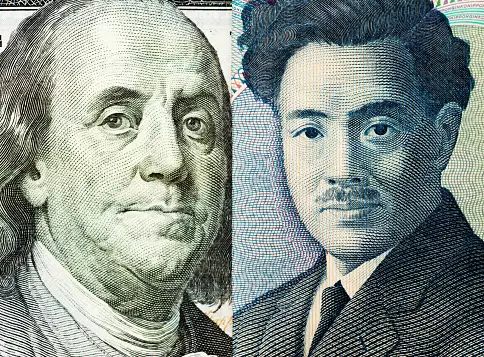

The yen has reached a level of weakness against the US dollar that has not been seen since late April. This has prompted the Bank of Japan to intervene in the currency market, deeming a rate above 160 yen per USD as unacceptable. Japanese officials have issued warnings against “excessive” volatility, hinting at the possibility of further interventions in the near future.

It is worth noting that previous interventions by the Bank of Japan in late April, which initially led to a 4.5% strengthening of the yen by the first days of May, were quickly counteracted by the market in less than two months. This suggests a strong upward trend driven by the interest rate differential between Japan and the US.

The weakness of the yen puts pressure on the Bank of Japan to reconsider its ultra-loose monetary policy. Importantly, yen weakness contributes to imported inflation, which further complicates the central bank’s decision-making process. The minutes from the latest central bank meeting revealed extensive discussions about reducing bond purchases and raising rates in response to these economic challenges.

Technical Analysis of USD/JPY

Analyzing the USD/JPY chart, it is evident that the rate is currently in an upward trend, lifting the dollar towards the upper half of the blue channel. The 158.20 level is identified as a potential support level, given its previous role as resistance and reinforcement by the median of the blue channel. There is a possibility that the USD/JPY rate could breach the upper boundary of the blue channel within the orange trend, potentially surpassing the multi-month peak from April.

Overall, the growing weakness of the yen against the US dollar carries significant implications for the Japanese economy. With the threat of imported inflation and pressure on the Bank of Japan to adjust its policy, it is essential for market participants to closely monitor the developments in the USD/JPY exchange rate. As the situation continues to evolve, traders are advised to stay informed and adapt their strategies accordingly.