The sell-off in GameStop shares was intensified on Wednesday afternoon, coinciding with a spike in trading volume in the call options owned by Roaring Kitty, whose legal name is Keith Gill. On Monday night, Gill disclosed that he still held 120,000 call options contracts with a strike price of $20 and an expiration date of June 21. The specific GameStop calls with the same strike price and expiration traded 93,266 contracts on Wednesday, significantly higher than the 30-day average volume of 10,233 contracts. The price of these contracts dropped over 40% during the session, while the stock itself fell by 16.5%. While it is uncertain if Roaring Kitty was behind this surge in trading volume, options traders speculated that his involvement was likely, given his significant holdings of these contracts.

Options traders have raised concerns about Gill having to sell his calls before the expiration date or rollover the position into new call options to avoid the need to come up with a substantial amount of cash to exercise them on the 21st. The potential sell-off of these contracts by Gill could potentially impact the price of GameStop stock. In order for Gill to exercise these calls, he would require $240 million to acquire the stock (equivalent to 12 million shares purchased at $20 each), an amount that surpasses the value he has publicly disclosed in his E-Trade account.

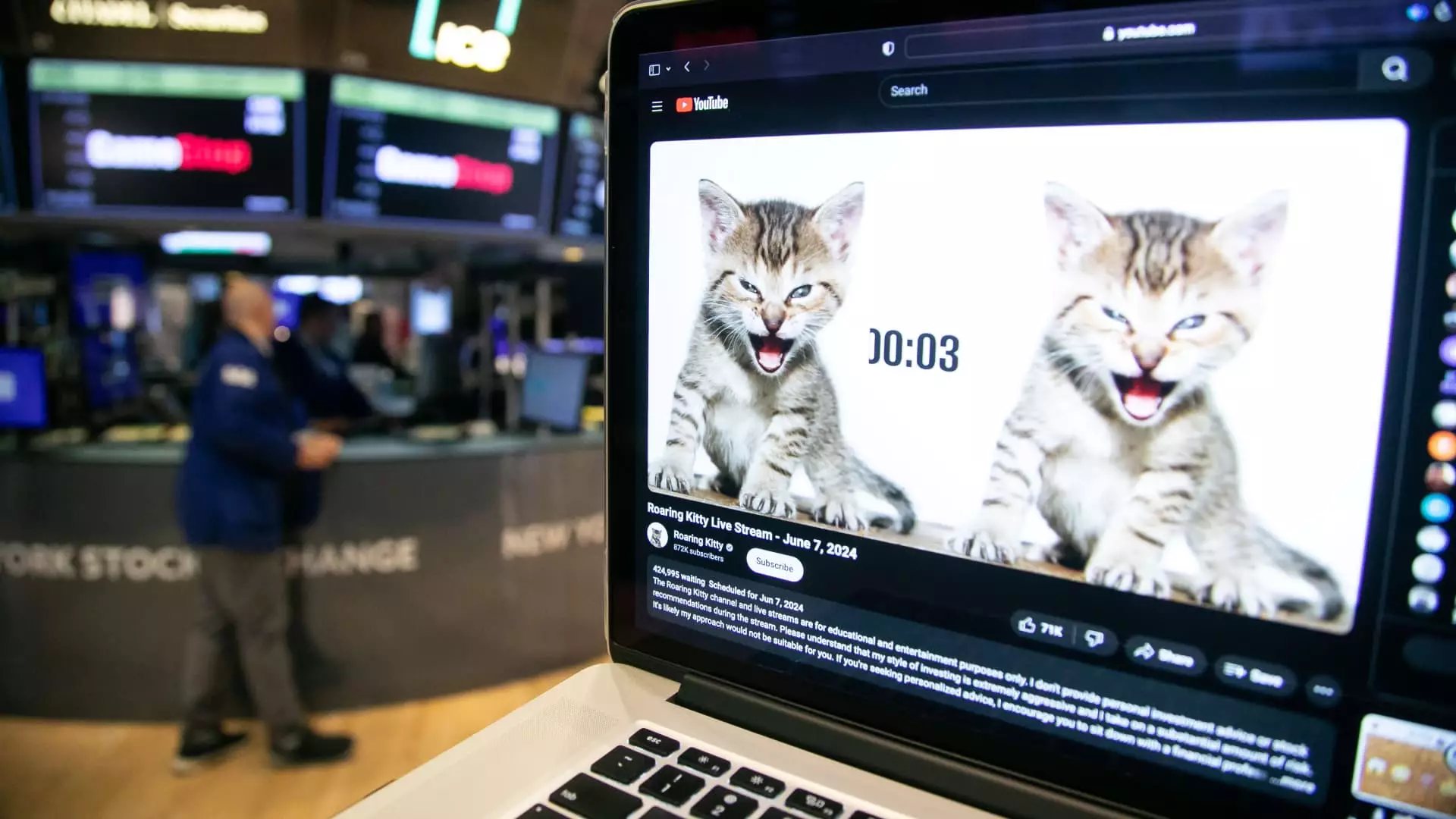

With Wall Street closely monitoring any indications that Gill might be offloading his position, the possibility of a significant impact on the stock price remains a topic of interest. The speculation surrounding the actions that Roaring Kitty might take leading up to the expiration date of the call options adds to the uncertainty and volatility surrounding GameStop shares. As the situation continues to evolve, investors and analysts alike are watching closely for any further developments that could shed light on Roaring Kitty’s next moves and the potential repercussions for GameStop stock.