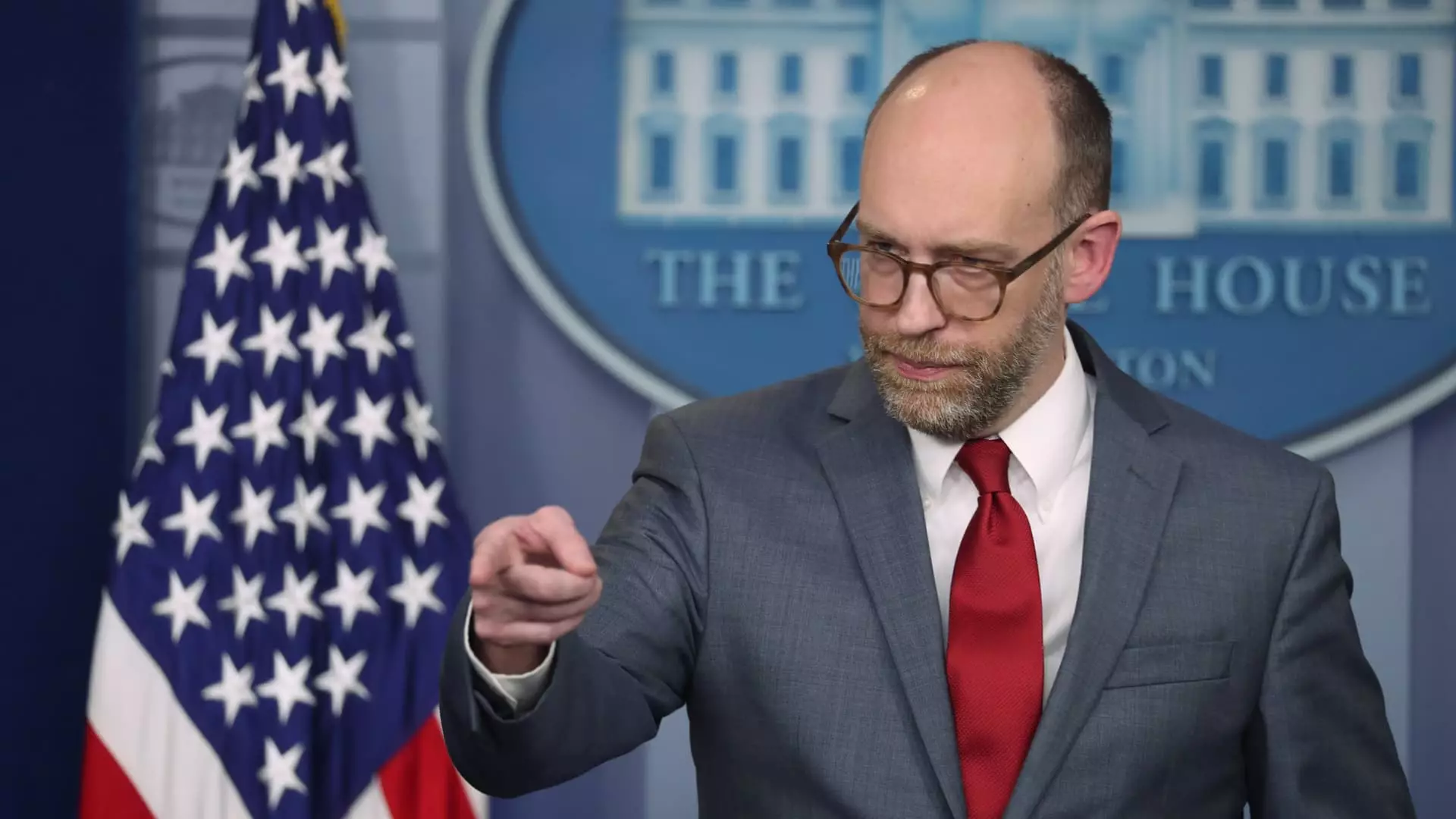

The Consumer Financial Protection Bureau (CFPB), a regulatory agency established to shield American consumers from exploitative financial practices, is now facing unprecedented turbulence. A recent memo disclosed a closure of its Washington, D.C. headquarters, directing its employees to transition to remote work until at least February 14. This directive came from the Chief Operating Officer, Adam Martinez, and was preceded by an edict from newly appointed acting director Russell Vought. The implications of these changes reverberate through financial markets and consumer protections, warranting a closer look at the factors and motivations behind this turmoil.

Vought’s communication to the CFPB staff has effectively put a halt to nearly all regulatory activities, including the essential task of supervising financial institutions. This suspension raises concerns about the agency’s future, especially considering Vought’s previous affiliations with the Trump administration and his current role in reshaping federal operations through Project 2025. His directives, especially regarding funding halts, serve as a clear signal to prioritizing a reduction of the CFPB’s influence. With Vought at the helm, the long-term integrity of consumer protection mechanisms hangs precariously in the balance.

Moreover, Twitter reactions from influential figures like Elon Musk have further ignited skepticism about the agency’s legitimacy. Musk’s provocative stance—calling for the CFPB’s demise—reflects wider sentiments among certain factions that deem the agency too intrusive. The intertwining of social media rhetoric and government policy dramatically influences public perception and legislative actions. Thus, the challenge is not solely administrative; it’s a narrative struggle that questions the CFPB’s role in the financial landscape.

Amidst these sweeping changes, CFPB employees have been gripped by uncertainty. The prospect of administrative leave or outright layoffs looms, mirroring tactics employed by previous administrations to dismantle federal regulatory bodies. Out of approximately 1,700 CFPB staff members, only a minority holds legally mandated positions, creating a precarious environment that could lead to mass layoffs without compromising essential functions.

If the agency’s workforce is significantly reduced, it poses a grave threat not only to the employees’ livelihoods but also to the fundamental mission of the CFPB. Established in the wake of the financially devastating 2008 crisis, the bureau was designed to act on behalf of consumers, ensuring that they do not fall prey to reckless banking practices. The danger of operational discontinuity and defunding could eradicate years of progress made in consumer protections against predatory lending, credit abuses, and indiscriminate fee practices.

In light of the recent freeze on activities, several pivotal consumer protection initiatives are uncertain. Proposed restrictions on credit card fees, overdraft penalties, and measures to alleviate the burden of medical debts on credit scores are all at risk. Without the CFPB’s oversight and regulatory authority, consumers could face a resurgence of exploitative practices that the agency was designed to combat. The potential removal of proscribed fees would not only impact individual consumers but also resonate through the economy, leading to a broader decline in financial wellness among everyday Americans.

The narrative surrounding the CFPB is deeply polarized; while it is viewed by many as an essential protective body, others paint it as an overreaching entity encroaching on business interests. Financial organizations have historically resisted CFPB regulations, attempting to challenge and undermine its legitimacy in court. This adversarial relationship sets the stage for a battle over the agency’s existence at a time when consumer rights could least afford such uncertainty.

The faltering state of the CFPB is emblematic of larger ideological battles over the role of government in financial markets. As consumer protections are threatened by leadership changes and potential funding cuts, the legacy and ongoing impact of the CFPB hang in the balance. It remains essential for advocates of consumer rights to remain vigilant, promote awareness, and engage in the ongoing debate about the future of financial regulation in the United States. The current situation presents an opportunity for broader discussions about accountability, regulation, and the protection of consumers in an increasingly complex financial landscape.