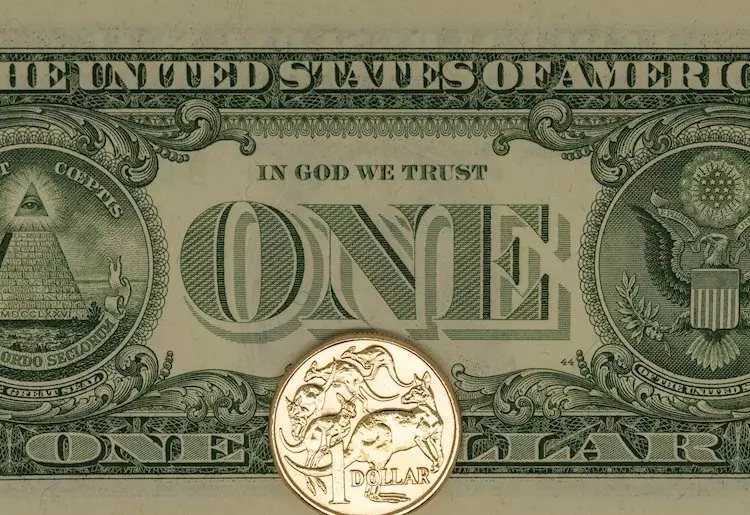

The Australian Dollar (AUD) has been experiencing a significant downward trend, especially in relation to the US Dollar (USD). As of Wednesday, the AUD/USD pair plummeted to a five-week low, dipping below the psychologically important 0.6700 mark. This decline is not merely a fluctuation in currency values; it indicates deeper issues affecting the Australian economy and its geopolitical environment. Recent events have reignited traders’ concerns about the currency’s viability, as various factors converge to create a perfect storm that continues to push the AUD down.

One of the primary drivers of this devaluation is the increased strength of the USD. Investors, facing uncertainty and instability, often gravitate toward the safety of the USD during market fluctuations. Additionally, ongoing concerns surrounding the state of China’s economy—Australia’s largest trading partner—further exacerbate the situation. Worrying signs emanate from China’s economic indicators, leaving traders skeptical about the efficacy of the Chinese government’s stimulus measures. The consequent drop in demand for Australian exports, particularly iron ore, only adds to the pressure on the AUD.

As the financial markets await crucial employment figures from Australia, slated for release on Thursday, there is mounting speculation regarding the Australian labor market’s health. Analysts predict a lackluster performance, which would not only solidify the currency’s bearish trajectory, but could also fuel expectations of a potential interest rate cut from the Reserve Bank of Australia (RBA).

Central to the RBA’s decisions is the rate of inflation, which has been persistently elevated. In light of this, the RBA has been focused on tightening monetary policy to rein in inflation, leading to speculation that cuts might be closer than previously thought. However, the market is pricing in only a modest interest rate cut of 0.25% in the forthcoming year, indicating a cautious approach among investors.

This leads us to a vital consideration—the correlation between currency strength and interest rates. If employment figures significantly underperform, it may induce the RBA to reconsider its strategy, potentially instigating a rate cut that would further depress the AUD. Therefore, traders are not just passively observing the data, but are actively positioning themselves based on anticipated outcomes.

Technical Analysis: Indicators Paint a Bleak Picture

Analyzing the technical aspects of the AUD/USD pair reveals a severe downward trajectory. The Relative Strength Index (RSI) reflects oversold conditions, suggesting that while there is intense pressure driving the price down, a pause for potential consolidation could be imminent. Nonetheless, the Moving Average Convergence Divergence (MACD) indicates that bearish momentum remains dominant, further complicating the outlook.

Support levels have now shifted to 0.6660, 0.6650, and 0.6630, while resistance points are positioned at 0.6700, 0.6730, and 0.6750. Should the downtrend continue, it is likely that traders will target the lower support levels as interim benchmarks.

The health of the Chinese economy remains one of the most crucial elements affecting the Australian Dollar. China’s demand for commodities, particularly iron ore, is vital for the Australian economy. In 2021, iron ore exports were valued at approximately $118 billion, with China absorbing a significant portion of these exports. As China’s economy fluctuates—especially in light of recent growth concerns—the impact is directly felt in the Australian markets.

Falling prices for iron ore, which often correlate with a weakening of the Chinese economy, can lead to a depletion of demand for the AUD. Conversely, a robust Chinese economy translates to greater demand for Australian exports, lifting the currency’s value. Thus, China’s economic performance serves as a barometer for AUD fluctuations.

Lastly, market sentiment cannot be overlooked when discussing AUD/USD dynamics. The interplay between risk-on and risk-off attitudes among investors tends to crucially influence currency trading. During times of market uncertainty, investors typically lean towards safer assets, which can bolster the USD at the expense of riskier commodities, including the Australian Dollar. Conversely, when market conditions improve, the appetite for riskier assets resurfaces, potentially reinvigorating the AUD.

While the immediate future appears grim for the AUD/USD pair, various elements—including employment data, interest rates, the state of the Chinese economy, and market sentiment—will significantly shape the trajectory of the currency. Traders must remain astute, closely monitoring developments to navigate this complex economic landscape effectively.