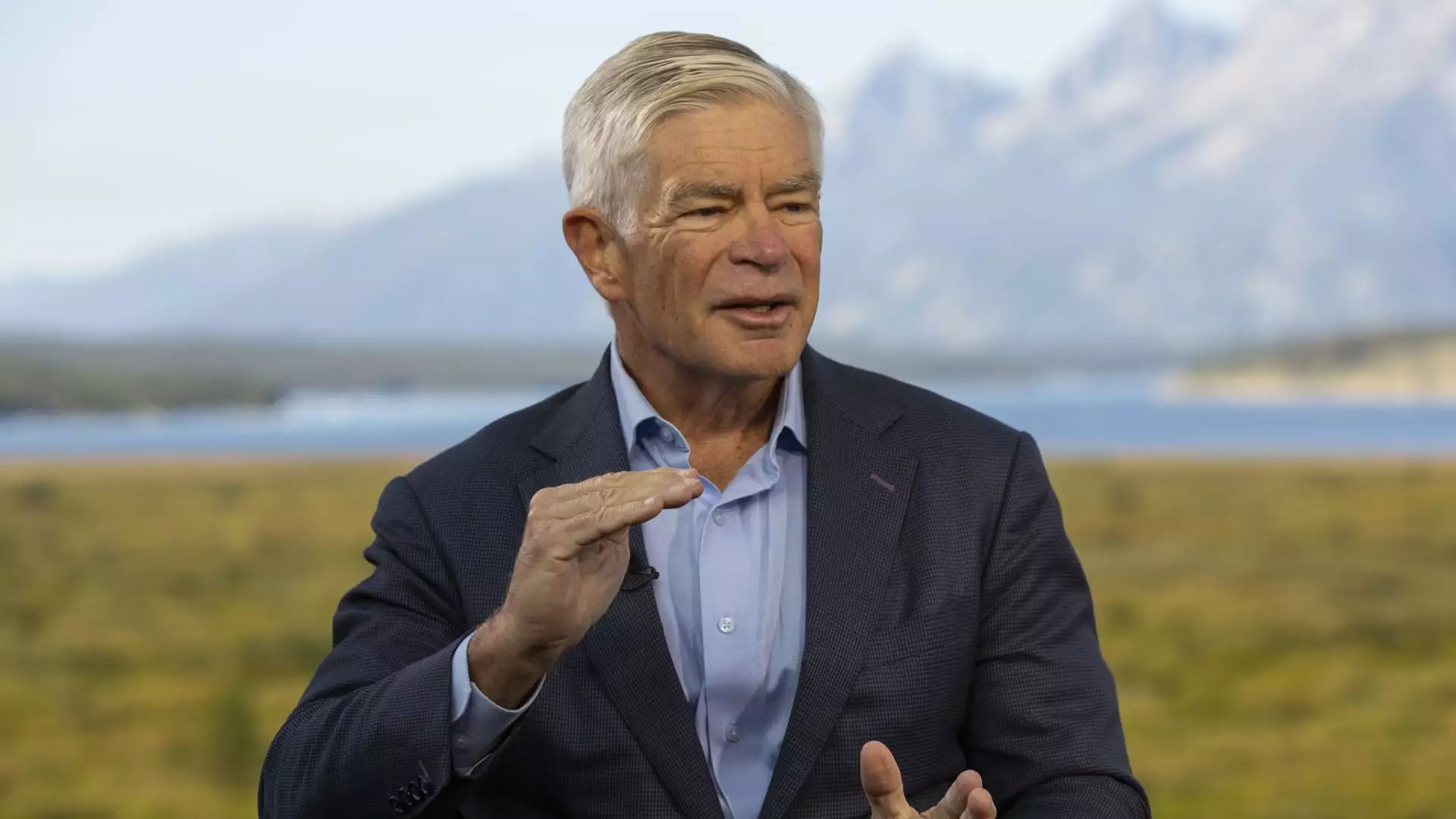

Philadelphia Federal Reserve President Patrick Harker recently voiced his support for an interest rate cut in September during an interview with CNBC. Harker’s statement marks a significant shift in the Federal Reserve’s stance on monetary policy easing, with Harker emphasizing the importance of moving rates down in a methodical manner.

Despite markets already pricing in a 100% certainty of a 25 basis point cut, there is still some uncertainty surrounding the magnitude of the rate cut. Harker mentioned that there is a 1-in-4 chance of a 50 basis point reduction, but he remains undecided on whether a 25 or 50 basis point cut is necessary. He emphasized the need to review additional data before making a final decision.

The Federal Reserve has maintained its benchmark overnight borrowing rate within a range of 5.25%-5.5% since July 2023, citing concerns about lingering inflation. Following the July Fed meeting, where officials signaled a reluctance to lower rates, policymakers have since acknowledged the need for policy easing to address potential weaknesses in the labor market.

Harker underscored the Fed’s commitment to making policy decisions independently of political considerations, particularly as the presidential election approaches. He expressed pride in the Fed’s role as “proud technocrats,” whose mandate is to analyze data objectively and respond accordingly. Harker’s view is that the current data supports a downward adjustment of rates.

Although Harker does not have a voting role on the Federal Open Market Committee this year, his input is still considered during meetings. Another nonvoting member, Kansas City Fed President Jeffrey Schmid, offered a more indirect perspective on future policy decisions. Schmid highlighted the impact of rising unemployment rates on inflation and expressed a leaning towards a rate cut.

Schmid pointed out a significant shift in the labor market, with indicators showing a slowdown in job growth and a gradual increase in the unemployment rate. He acknowledged the role of a supply-demand mismatch in driving inflation but suggested that the cooling labor market may alleviate some of these pressures. Nevertheless, Schmid emphasized the need for continued monitoring and potential policy adjustments.

Despite the possibility of an interest rate cut, Schmid expressed confidence in banks’ resilience under the current high-rate environment. He argued that monetary policy is not overly restrictive and that there is still room for maneuvering to support economic growth. Both Harker and Schmid will continue to monitor economic developments closely and contribute to future policy decisions in their respective roles within the Federal Reserve.

Philadelphia Federal Reserve President Patrick Harker’s endorsement of an interest rate cut reflects a broader shift in the Federal Reserve’s stance on monetary policy easing. As economic conditions evolve and uncertainties persist, policymakers like Harker and Schmid will play a crucial role in shaping the future direction of monetary policy to support sustainable economic growth.