In an era where digital interactions dominate our daily lives, the risk of online fraud has surged, thrusting the issue into the limelight. Financial technology companies like Revolut are now vocal about the inadequacies demonstrated by major social media platforms, particularly Meta (formerly Facebook). The fintech sector feels an ethical responsibility to elevate discussions surrounding consumer safety, urging tech giants to take accountability for the scams that proliferate on their platforms.

Revolut’s Bold Critique of Meta

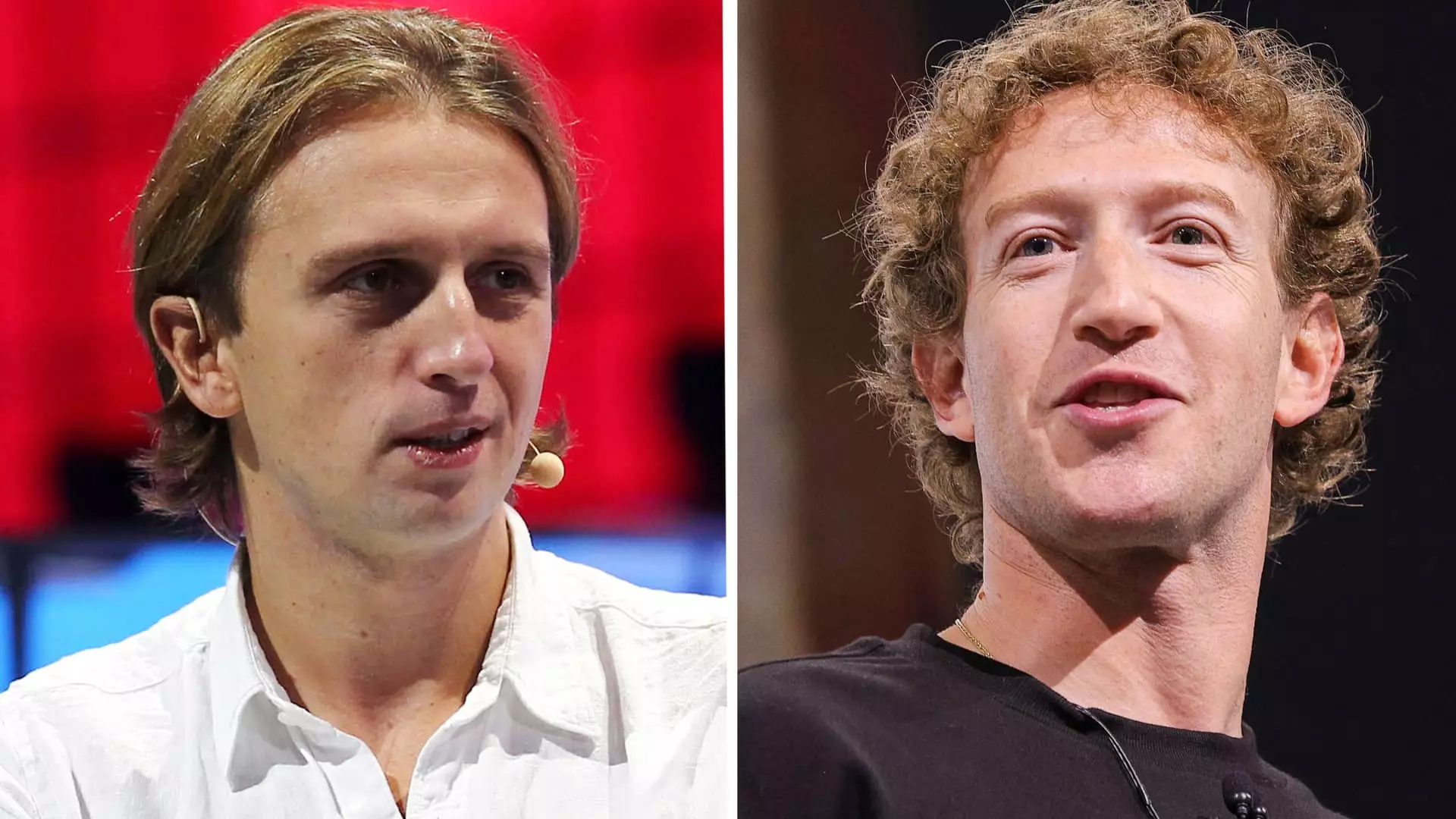

On Thursday, Revolut expressed significant criticism towards Meta’s measures for combating online fraud, labeling them as insufficient. The comments from Woody Malouf, Revolut’s head of financial crime, highlighted a discontent with Meta’s recent collaboration with NatWest and Metro Bank aimed at sharing data to prevent fraud. According to Malouf, such initiatives are merely “baby steps.” This insinuates a call to action for bolder strategies that can create substantial barriers against fraudulent activities that exploit users.

Malouf’s statement encapsulates a growing frustration within the fintech community. The expectation is not limited to data protection but extends to direct compensation for victims of fraud initiated through social media channels. Revolut argues that without a system in place to reimburse victims, platforms like Meta lack the motivation to enhance their fraud prevention efforts effectively.

Amidst these discussions, the U.K. has been making headway towards reforming its approach to compensation for fraud victims. New regulations set to take effect on October 7 enforce that banks and payment service providers must offer victims of authorized push payment (APP) fraud compensation up to £85,000 ($111,000). This decision comes as a relief to many, but it serves as a stark reminder of the financial vulnerability that individuals face.

The Payments System Regulator’s previous suggestion for a maximum reimbursement of £415,000 revealed the contentious nature of fraud compensation discussions. This pushback from banks showcases the complex dynamics at play, where financial institutions aim to protect their bottom lines while consumers seek justice against fraudsters.

As the landscape of digital fraud continues to evolve, the conversation around accountability is more critical than ever. Revolut positions itself as an advocate for consumers, aligning with efforts to hold social media platforms responsible for the ramifications of scams that emanate from their sites. By implementing reforms that obligate tech companies to compensate victims, there could be a significant shift in how online fraud is tackled.

Targeting the root of the fraud issue on social media cannot come solely from passive measures; active engagement and responsibility from these platforms are essential. Revolut’s call to action resonates with many as they encourage the adoption of a more comprehensive approach that prioritizes consumer protection and accountability—transforming a reactive strategy into one that is proactive and robust.

Ultimately, the path forward requires collaboration between financial institutions, regulatory bodies, and social media platforms. With Revolut’s critique serving as a wake-up call, there is an urgent need for Meta and similar organizations to recognize their pivotal role in mitigating fraud. By taking decisive action and ensuring victim compensation, these platforms can not only protect consumers but also bolster trust and credibility within the financial landscape. As the digital world continues to expand, so does the responsibility to safeguard its users. The industry must prioritize these changes if it aims to stay relevant and resilient against fraud.