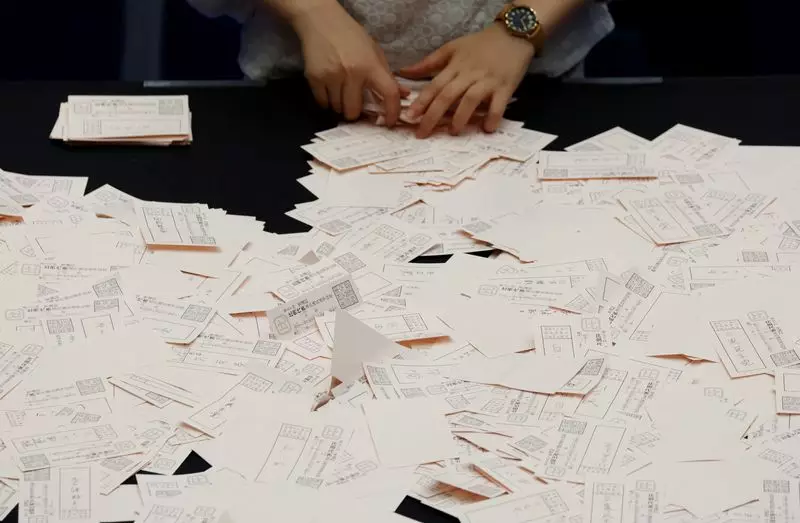

As we step into a crucial week for global financial markets, the Asian economic sphere finds itself at a crossroad. The recent political upheaval in Japan following Prime Minister Shigeru Ishiba’s loss of parliamentary majority has sent ripples across the continent. Historically, the Liberal Democratic Party (LDP) has maintained a firm grip on Japanese politics, making this electoral defeat a significant event. Investors are gearing up for heightened volatility, particularly in Japanese markets, as they navigate the implications of this political shift.

The immediate reaction to Ishiba’s loss is likely to be a downturn in both the yen and Japanese equities. Typically, such political uncertainty raises concerns about governance and economic continuity, which can lead to diminished investor confidence. Higher demand for Japanese Government Bonds (JGBs) might also emerge as investors seek safer assets in uncertain times. This scenario amplifies worries over the Bank of Japan’s (BOJ) ability to implement its monetary policy effectively, particularly as it approaches a critical interest rate decision on Wednesday. The absence of a stable political environment could hinder the BOJ’s efforts to spur economic growth and combat deflationary pressures that have plagued Japan for decades.

Beyond Japan, the week is packed with pivotal events that could dictate global market sentiment. A noteworthy highlight is the earnings reports from several leading American technology firms, collectively known as the ‘Magnificent Seven.’ Given their immense market influence, strong earnings could rejuvenate investor confidence, while disappointing results may trigger a broader market sell-off. Additionally, the U.S. nonfarm payroll report set for release on Friday carries significant weight. It serves not only as an indicator of domestic economic health but also influences Federal Reserve policy and, by extension, global interest rates.

In the Asian context, the purchasing managers’ index (PMI) data for October is also on the radar. It will provide insights into regional economic conditions, particularly in China, amidst concerns over the effectiveness of recent governmental stimulus measures. As the world’s second-largest economy grapples with a substantial 27.1% decline in industrial profits for September, questions arise regarding the sustainability of its growth trajectory.

Asian markets have displayed a tendency to retreat recently, with the MSCI Asia ex-Japan index declining nearly 2% last week. Japan’s own Nikkei 225 index fell by 2.7%, marking the second consecutive week of losses as investors pulled back in response to the approaching elections. This trend stands in stark contrast to the performance of the Nasdaq, which has experienced a robust upward trend fueled by strong results from companies like Tesla. The tech-heavy index, having gained for seven consecutive weeks, exemplifies a resilient U.S. market amidst global uncertainties.

The implications for Asian emerging markets are not entirely optimistic. The dollar’s strength and the anticipated elevated U.S. interest rates pose challenges. According to analysis from Barclays, the conditions could foster a “challenging environment” for emerging market assets, limiting their potential for growth as global investors seek security in more stable economies.

As we progress through the week, market participants must remain vigilant. The looming U.S. Presidential election on November 5 promises to add another layer of uncertainty, further influencing market dynamics. With numerous event risks on the horizon, investors might hesitate to commit to new positions, which could disproportionately affect riskier assets.

As political and economic landscapes evolve, both in Asia and globally, the interplay between domestic policies and international market forces will be critical. Investors must navigate this landscape with a cautious approach, recognizing the interconnectedness of these developments while aiming to position themselves strategically for both short-term fluctuations and long-term growth opportunities. The next few days will be telling, as markets adjust to the realities of political change and economic data.