Gold price continues to trade positively, influenced by the weaker USD. The recent downbeat US jobs data for April has led to speculation of potential rate cuts by the Fed in the coming months. This expectation of an easing cycle could boost the gold price as it becomes a cheaper option for foreign buyers. Moreover, strong central bank purchases and demand from Asian markets are supporting the precious metal. However, signs of ongoing political tensions in the Middle East may bolster the safe-haven flows and benefit the gold price.

The hawkish tone from Fed officials, such as Fed Bank of Minneapolis President Neel Kashkari, could support the USD and weigh on the gold price. The comments made by Richmond Fed President Thomas Barkin and New York Fed President John Williams regarding rate cuts and job growth moderation are impacting market sentiments. The expectation of rate cuts by the Fed, priced in by markets, is further adding to the uncertainty in the gold price.

The acceptance of an Egyptian-Qatari cease-fire plan by Hamas and Israel’s rejection of the deal have added to the geopolitical tensions in the Middle East. Such events can create fluctuations in market sentiment, impacting the demand for safe-haven assets like gold. Any resolution or escalation of these tensions could influence the gold price in the near term.

Technical Analysis and Price Targets

In terms of technical analysis, gold price remains above the key 100-day Exponential Moving Average (EMA) on the daily timeframe, indicating a constructive outlook. The path of least resistance is currently to the upside, with the 14-day Relative Strength Index (RSI) in bullish territory. The first upside target for the precious metal is identified near the $2,350-$2,355 zone, followed by the psychological barrier of $2,400 and the all-time high near $2,432. On the downside, key support levels include $2,300, $2,275, and $2,228.

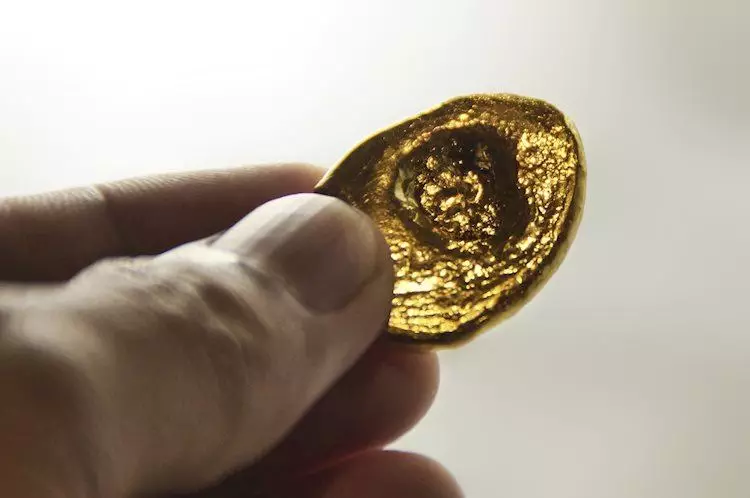

Gold has played a significant role in human history as a store of value and medium of exchange. In current times, gold is considered a safe-haven asset and a hedge against inflation and depreciating currencies. Central banks, as major gold holders, use gold reserves to strengthen the perceived solvency of their economies. The high level of gold reserves held by central banks, particularly in emerging economies, contributes to the stability of the global economy.

Gold has an inverse correlation with the US Dollar and US Treasuries, as well as with risk assets. Geopolitical instability, economic uncertainty, and fluctuations in the stock market can impact the price of gold. Additionally, interest rates and the behavior of the US Dollar play a crucial role in determining the direction of gold prices. As a yield-less asset priced in dollars, gold price movements are interconnected with global economic conditions and market sentiment.

The gold price outlook is influenced by a combination of factors such as USD movement, US economic data, geopolitical events, market sentiment, technical analysis, and the role of gold in the economy. Understanding the interplay of these elements is essential for investors and traders to make informed decisions regarding gold investments. By closely monitoring these factors, market participants can better navigate the dynamics of the gold market and capitalize on potential opportunities presented by fluctuations in the price of this precious metal.