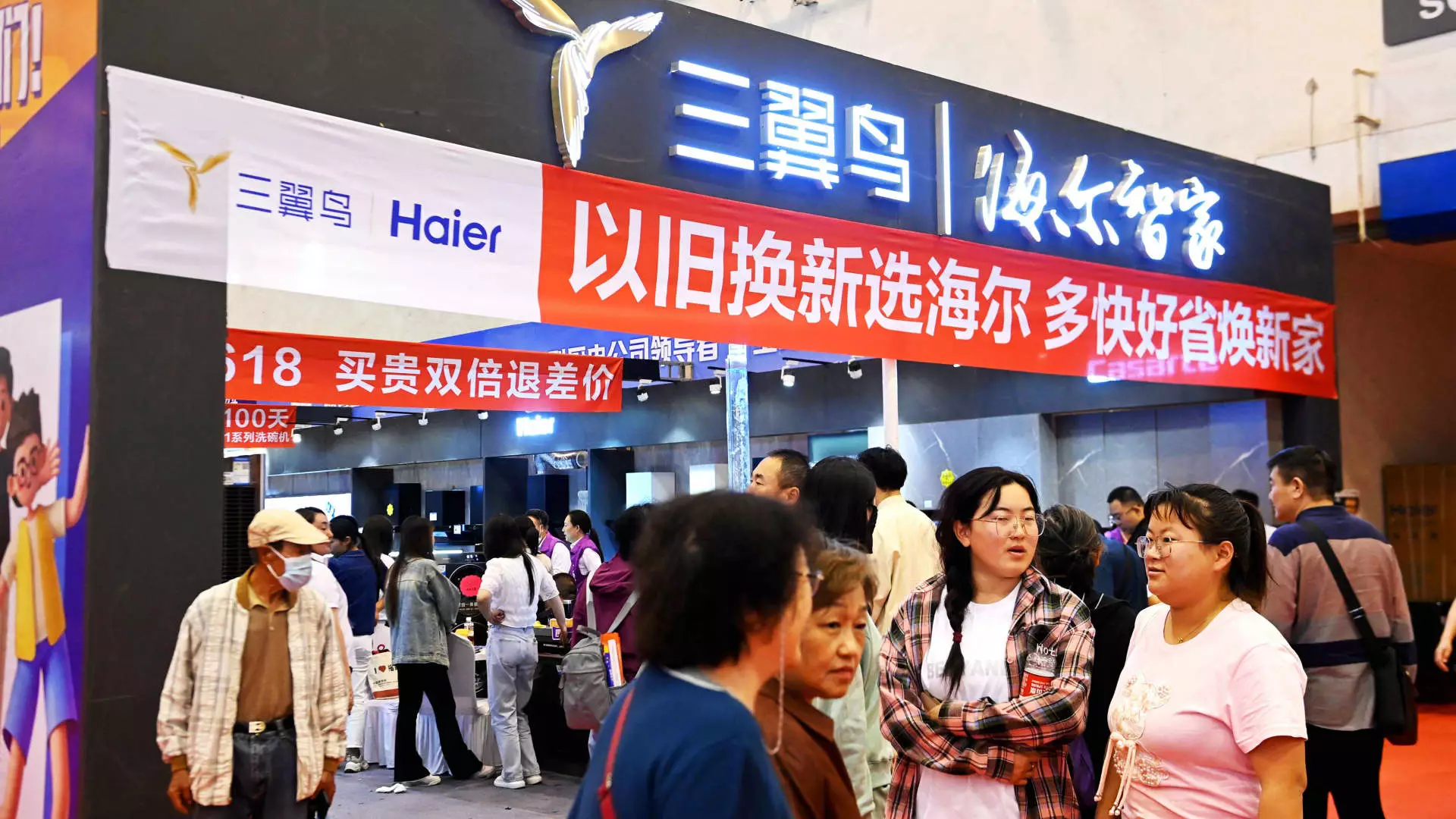

In July 2023, the Chinese government launched a comprehensive plan aimed at revitalizing domestic consumption. This initiative involved the allocation of 300 billion yuan ($41.5 billion) in ultra-long special government bonds specifically intended to support a trade-in and equipment upgrade policy. The overarching goal was to stimulate spending within the economy by enticing consumers to trade in their older, less efficient products for new ones. Half of the allocated funds were earmarked for subsidizing the trade-ins of large consumer goods like automobiles and home appliances, while the remainder was directed towards enhancing the upgrade of significant infrastructure, such as elevators. Despite these bold measures, the anticipated uptick in consumer activity has been notably sluggish.

Reports from various businesses suggest that the implementation of the trade-in program has failed to translate into tangible benefits on the ground. Jens Eskelund, president of the EU Chamber of Commerce in China, remarked that the measures have not yet resulted in a visible increase in consumer spending or business orders. His comments reflect a broader skepticism among analysts regarding the effectiveness of the trade-in initiative. Many business leaders are looking for clearer execution and measurable outcomes to justify the government’s investment. In analysis conducted by the chamber, it was revealed that the average consumer might only receive about 210 yuan ($29.50) from the trade-in subsidies, which raises doubts as to whether this amount will spur significant increases in consumer spending.

Challenges to Consumer Engagement

One of the key obstacles that the trade-in program faces is the conservative nature of the Chinese consumer. The structure of the program requires consumers to spend money upfront and possess a trade-in item, which can be a significant barrier. There is an inherent risk in expecting cautious consumers, who are already navigating economic uncertainties, to make additional purchases solely based on some form of subsidy. Analysts, including those from UBS Investment Bank, project that the initiative might only influence roughly 0.3% of retail sales in 2023 — a meager figure in the context of the overall economy.

Mixed Signals in the Retail Market

In the backdrop of this trade-in initiative, China’s retail figures have presented a mixed picture. Retail sales growth in recent months has shown signs of stagnation, with just 2% growth in June — the slowest rate since the COVID-19 pandemic — followed by a slight uptick to 2.7% in July. However, exceptions to this trend were found in the new energy vehicle segment, which experienced a 37% surge in sales, indicating that while some sectors may respond favorably, broader retail trends remain uninspiring. The trade-in policy has attempted to stimulate sales through increased subsidies for both new energy and traditional vehicles, but the impact appears restrained.

The Hesitance of Major Equipment Suppliers

While the policy’s focus lies on upgrading substantial assets like elevators, even leading manufacturers have voiced concerns. Foreign companies in the elevator sector, such as Otis and Kone, have signaled that the anticipated volume of orders under this new program remains elusive. Kone’s financial performance in China has declined over the past year, largely influenced by a struggling property market despite the broader opportunity presented by the new government policies. As they navigate this inflection point, these businesses are hopeful but uncertain about the timeline for materializing benefits, echoing the sentiments of many in China’s private sector landscape.

Despite short-term challenges, some industry experts remain optimistic about the long-term prospects of the trade-in policy. For instance, while the CFO of ATRenew highlighted lackluster immediate impacts, he emphasized the potential for nurturing the secondhand market ecosystem in China. As the trade-in platform gradually gains traction, it may indeed support a more sustainable market structure where consumers are encouraged to recycle and upgrade their possessions. In targeted regions, such as parts of Guangdong province, there have been early signs of increased trade-in activity, particularly within tech products like mobile phones, spurred by e-commerce platforms like JD.com.

Conclusion: A Work in Progress

Ultimately, while the Chinese government’s trade-in initiative aims to trigger a consumption boom, its success hinges on effective execution and consumer engagement. The skepticism from businesses suggests that the journey might be more complex than anticipated. As companies position themselves to detract maximum benefit from the policy, it will be crucial for government bodies to ensure clarity, accessibility, and tangible incentives within the program. Whether or not this initiative can revitalize consumer spending remains to be seen, but it is clear that a transformative approach rooted in both economic understanding and consumer behavior will be essential for meaningful progress in stimulating the economy.