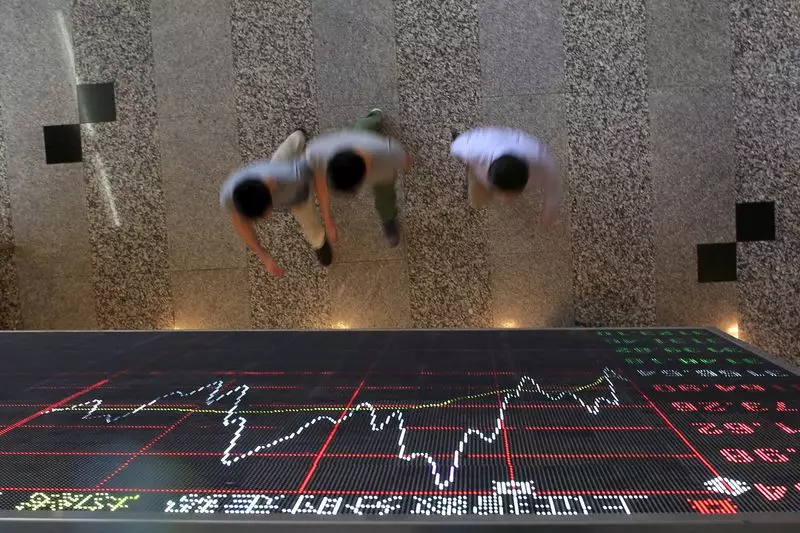

China’s data-driven quant trading funds are rapidly expanding overseas as competition intensifies at home. With regulators tightening scrutiny of the $260 billion sector, firms like Meridian & Saturn Capital (MS Capital) are beginning to offer their China strategy to offshore investors.

DH Fund Management recently established its first offshore fund in March, signifying a move towards investing in global markets. Similarly, Beijing-based Ubiquant is planning to open a U.S. office, highlighting the industry’s push towards international growth.

The surge in Chinese quant hedge funds venturing into overseas markets is a response to the crowded domestic industry and increasing regulatory supervision. Many funds are seeking exposure to European and U.S. investors while also needing to establish offshore structures to navigate evolving compliance rules.

As Chinese quant funds extend their reach into global markets, they face head-to-head competition with established giants like Winton, Man Group, and Two Sigma. Relying on innovative strategies, these firms aim to capture ‘alpha’ or market outperformance amidst dynamic market conditions.

China’s vast and volatile market provides quant funds an edge in generating ‘alpha’ through automated programme trading. By leveraging computer models to swiftly capture market fluctuations, firms like MS Capital are able to offer investors a China-focused market-neutral strategy.

In response to changing compliance rules in China, some quant funds are diversifying their operations by setting up investment centers in locations like Hong Kong and Singapore. These strategic moves enable funds to operate more freely and potentially enhance performance in offshore markets.

With a growing number of Chinese funds not only raising capital overseas but also investing abroad, the industry is witnessing a shift towards building global brands. Firms like Minhong Investment are preparing strategies targeting markets in Japan and India, while receiving increased interest from Chinese fund managers seeking to launch global initiatives.

Overall, China’s quant trading funds are rapidly evolving to adapt to changing market conditions and regulatory environments. As they expand their presence in global markets, these firms are poised to compete with international giants while seizing new opportunities for growth and innovation.