As the first week of 2025 progresses, Asian stock markets are exhibiting resilience amidst a backdrop of various global economic concerns. Despite a slow start to the year, which has left many investors apprehensive, the MSCI Asia-Pacific index outside of Japan has shown a slight increase of 0.33%. However, it is essential to note that the index is set to conclude the week nearly 1% down, a disappointment following a robust performance throughout 2024 where it surged close to 8%.

Investor sentiment seems to be fluctuating significantly as they navigate concerns surrounding monetary policy and geopolitical tensions. The U.S. dollar has reached a two-year high against a basket of currencies, primarily due to apprehensions that interest rates in the U.S. may remain elevated longer than anticipated.

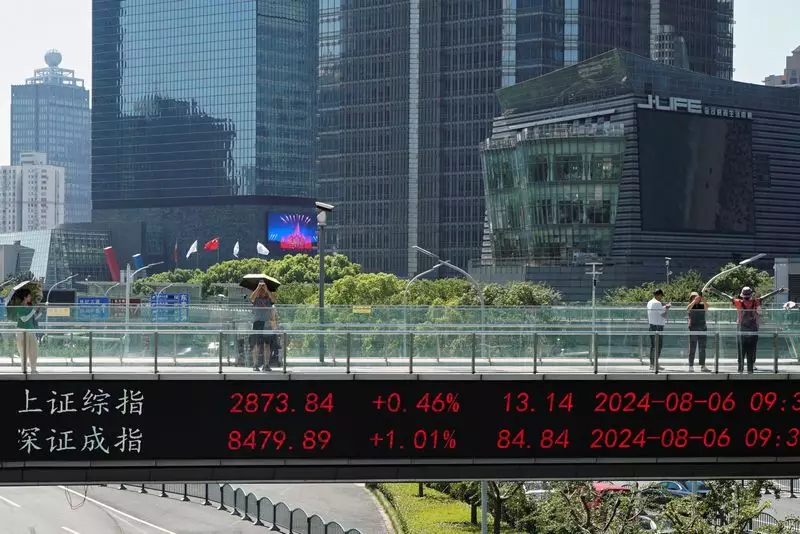

China’s Economic Landscape

In China, the economic outlook appears precarious. Thursday marked a troubling turn for investors as the blue-chip CSI 300 Index recorded its weakest start to the New Year since 2016. On a positive note, trading on Friday was steady, with the index registering a modest increase of 0.16%. However, the shadow of economic instability looms large, heightened by fears of a potential trade conflict coinciding with the presidency of Donald Trump. Analysts express concern that the assertive trade policies expected from the new administration could exacerbate existing economic woes in China.

The Hang Seng Index in Hong Kong also showed a slight recovery, posting a gain of 0.19%. Ben Bennett, an investment strategist at Legal and General Investment Management, remarked on the current market dynamics indicating that while periods of low liquidity can lead to unpredictable market movements, the overarching trends projecting a stronger dollar along with rising bond yields signal potential challenges for equity investors moving forward.

The situation isn’t much cheerier in the United States, as evidenced by the stock market’s performance on Thursday, where widespread declines followed initial gains. Tesla’s significant drop of 6.1% further contributed to the negative sentiment, primarily due to their bleak annual delivery figures. This downturn signals a broader struggle for companies to maintain growth momentum as expectations from the previous year begin to dissipate.

The Federal Reserve’s actions in December sent shockwaves through the market, as projections for fewer rate cuts than previously expected dampened investor enthusiasm. The mix of potential inflationary pressure from Trump’s policies and the Fed’s strategic moves has left traders cautious. Vasu Menon from OCBC highlights that while Trump’s agenda could stimulate the U.S. economy, it poses challenges globally, particularly concerning tariffs and fluctuations in currency valuations.

Recent data from the U.S. indicates a drop in new unemployment claims to an eight-month low of 211,000, implying a tight labor market as the year unfolds. This bullish indicator, along with upcoming payroll and inflation reports, will be critical as market participants assess how the Fed may adjust its rate strategy. Presently, traders are anticipating approximately 44 basis points of rate easing in 2025, slightly below the 50 basis points projected previously.

The dollar index has maintained strength, currently at 109.2. As a consequence of these developments, the euro has taken a considerable hit, suffering a sharp 0.86% decline to reach a low of approximately $1.0225—the lowest it has been in two years. The yen too remains under pressure, experiencing a more than 10% depreciation throughout the previous year.

Despite the challenges faced in the equity markets, certain commodities are reflecting notable resilience. Oil prices have risen marginally, buoyed by optimistic projections about China’s economic revival fueled by President Xi Jinping’s commitment to growth. Brent crude futures rose by 0.16%, while West Texas Intermediate crude climbed slightly at 0.18%. In contrast, gold prices have remained steady, fixing at $2,658 per ounce following a remarkable 27% increase in 2024, marking its best yearly performance since a decade.

Asian markets are treading carefully as 2025 begins, influenced by a medley of factors including U.S. monetary policy, geopolitical tensions, and evolving economic conditions across the region. The strong dollar and rising bond yields present challenges for investors, yet there remain pockets of opportunity—especially in commodities that could provide stability amidst market fluctuations. As data from the U.S. economy continues to unfold, market participants will remain vigilant, adapting to the rapidly changing landscape shaped by both national and international developments.