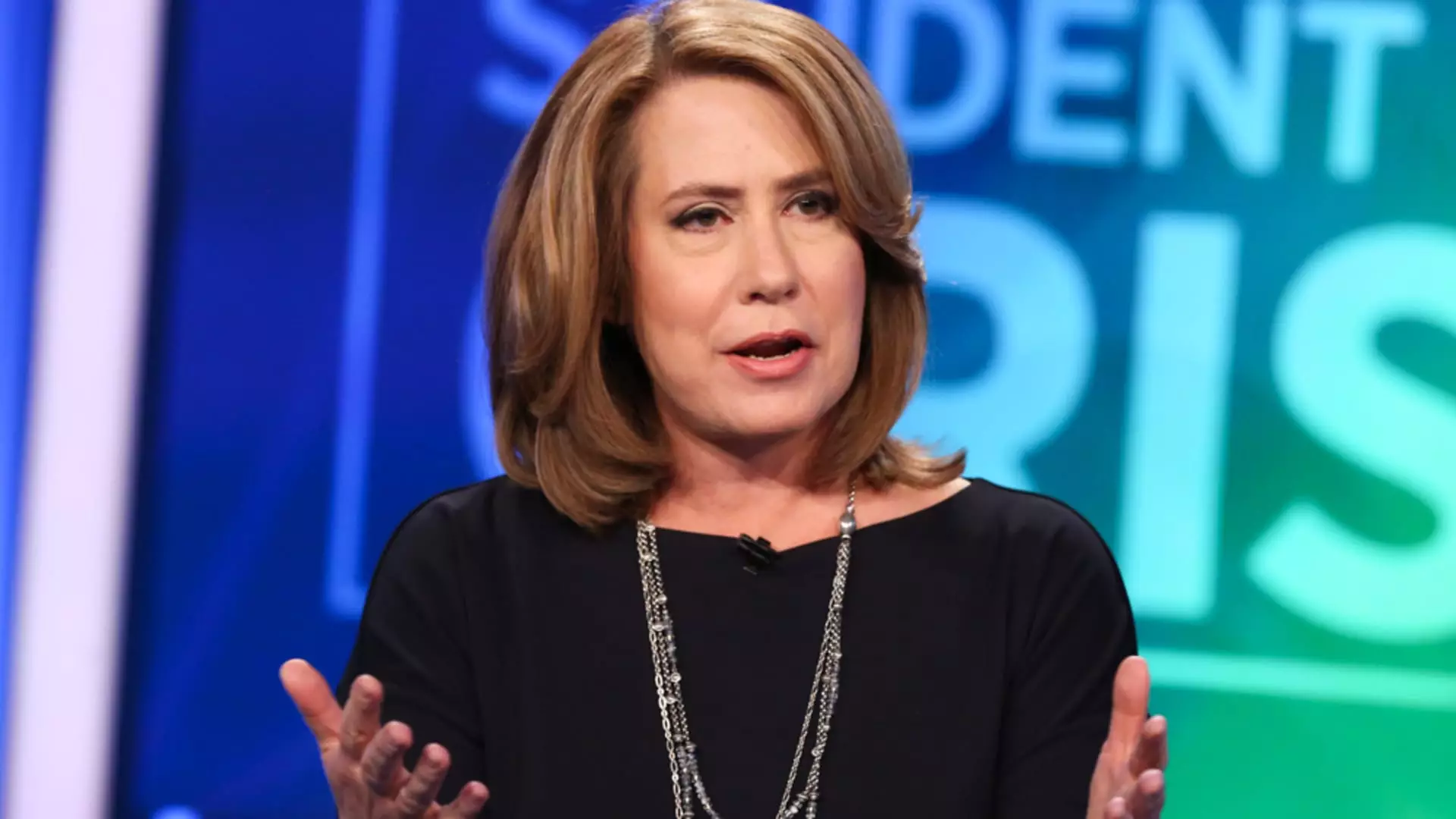

Sheila Bair, former chair of the U.S. Federal Deposit Insurance Corp, has raised concerns about the quarterly earnings of regional banks, suggesting that they may expose critical weaknesses within the industry. Bair, who steered the FDIC through the turbulent times of the 2008 financial crisis, expressed her worries on CNBC’s “Fast Money” show. She specifically pointed out that some regional banks are still heavily reliant on industry deposits, have significant exposure to concentrated commercial real estate, and could face instability with uninsured deposits if another bank failure were to occur.

Bair emphasized that the issues faced by regional banks in 2023 have not been fully resolved, highlighting the need for Congress to reinstate the FDIC’s transaction account guarantee authority. This, she believes, would help stabilize deposits and prevent any potential failures. The Regional Bank ETF (KRE) has struggled this year, with major players like New York Community Bancorp experiencing a significant decline. The uncertainties surrounding uninsured deposits in the event of a bank failure remain a major challenge for these institutions.

The recent spike in the benchmark 10-year Treasury note yield, surpassing 4.6%, has amplified concerns for regional banks. Bair expressed apprehension that higher yields could place additional stress on commercial real estate borrowers, given the substantial exposure of regional banks to this sector. As many commercial real estate loans are set to refinance in the coming years, rising interest rates could exacerbate financial strains for borrowers.

Shift Towards Larger Institutions

Despite the challenges faced by regional banks, Bair noted that their distress could potentially benefit larger money-center banks. The difficulties encountered by regional institutions may lead to a migration of business towards bigger players in the financial sector. This dynamic underscores the interconnectedness of the banking industry and how challenges faced by one segment can have ripple effects across the entire financial landscape.

The vulnerabilities of regional banks underscore the need for continued vigilance and proactive measures to address underlying weaknesses. As industry dynamics evolve and external factors like rising interest rates come into play, regional banks must adapt to navigate the changing landscape. The insights provided by Sheila Bair serve as a timely reminder of the importance of risk management and regulatory oversight in safeguarding the stability of the banking sector.