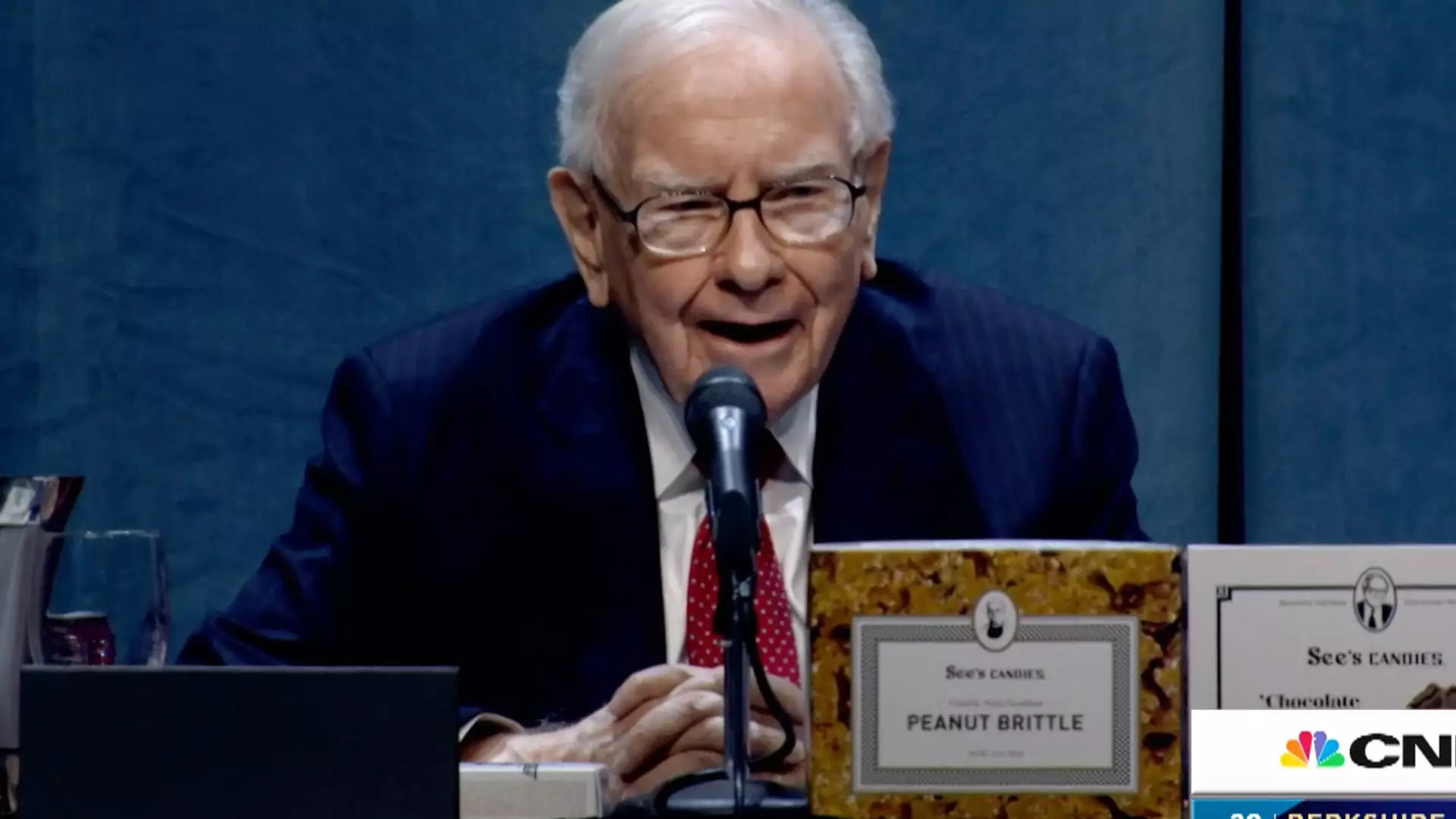

In recent discourse about trade policy, Berkshire Hathaway’s CEO Warren Buffett has offered a notable critique of President Donald Trump’s approach to tariffs, a subject he approached with a mix of humor and gravity. Buffett’s statement, “tariffs are actually…an act of war, to some degree,” highlights his belief that such fiscal measures are more than just economic tools; they can incite broader conflicts and complications for consumers. This rare commentary reflects the enduring wisdom of a financial maestro known for his in-depth understanding of market dynamics and long-term investment strategies.

Buffett elegantly articulated the essence of tariffs as a form of taxation on goods, stating, “Over time, they are a tax on goods. I mean, the Tooth Fairy doesn’t pay ’em!” This playful remark underscores a serious truth: the ultimate burden of tariffs falls on the consumer. By artificially inflating prices, tariffs can lead to increased living costs that disproportionately affect lower-income households. The implications are clear: as tariffs elevate product prices, inflation becomes a tangible risk that could stifle economic growth and consumer spending.

This insight comes against the backdrop of Buffett’s history of caution regarding trade conflicts. During Trump’s initial term, he voiced concerns over tariff implementations that he believed could destabilize not only the U.S. economy but also have ripple effects globally. His stance is informed by decades of experience in navigating economic cycles, suggesting a level of prudence that favors long-term strategic planning over short-term gains. By reminding the public to ask the critical question, “And then what?” Buffett encourages a deeper examination of the cascading consequences of such policies.

Currently, with volatility permeating financial markets and growing fears about economic stagnation, Buffett’s recent actions are scrutinized. He has significantly liquidated stock positions and amassed an unprecedented amount of cash reserves, prompting mixed interpretations from analysts. Some see this as a bearish signal indicating a lack of confidence in the market’s near-term prospects, while others posit that it reflects a strategic pivot in preparation for Berkshire’s future leadership.

Amid fluctuating valuations and unpredictable policy announcements, market sentiment appears fragile. As observed, the S&P 500 has shown marginal gains this year, highlighting a period of stagnation rather than robust growth. This climate of uncertainty fuels speculation regarding the sustainability of current economic policies and their ability to foster consumer confidence.

Warren Buffett’s insights regarding tariffs and their potential crippling effects on consumers and the economy are a clarion call for stakeholders to reassess the long-term implications of trade policies. His narrative serves as a reminder that economic decisions should be guided not just by immediate outcomes but also by their broader impact on society and the market at large.