As the year draws to a close, financial markets across Asia are experiencing a measured uptick, reflecting a complex interplay of factors that have been shaping the economic landscape. Despite the usual holiday trading lull, investor sentiment appears cautiously optimistic, underscored by a strong U.S. dollar and evolving interest rate expectations from the Federal Reserve.

December typically signifies a period of reduced trading activity as investors begin to wind down for the holidays. This year is no exception, with trading volumes noticeably lighter. However, amidst this seasonal dip, there is a palpable focus on the Federal Reserve’s guidance regarding interest rates. Recent comments from Fed Chair Jerome Powell suggest a pivot towards a less aggressive monetary policy, spurring traders to reassess the outlook for rate cuts in the upcoming year. Current estimations indicate that markets are only anticipating around 35 basis points of easing in 2025, representing a significant recalibration of expectations from earlier in the year.

This shift has had a notable impact on bond markets; U.S. Treasury yields have been on the rise, reflecting growing confidence in the dollar’s strength. The benchmark 10-year yield has hovered around 4.60%, marking its highest levels since late May. Meanwhile, the two-year yield has also shown resilience, a development that investors are keenly monitoring as indications of future economic conditions emerge.

The U.S. dollar has enjoyed a robust rally, recently achieving a two-year peak against a collection of global currencies. As of the last trading sessions, the dollar index stood close to 108.15, indicating a strong month of gains amidst persistent economic uncertainties in various regions. Specifically, the Australian and New Zealand dollars have faced significant depreciation against the dollar, reflective of market sentiment and local economic challenges. The Australian dollar fell 0.45% to $0.6241, while the New Zealand dollar slipped 0.51% to $0.5650, as traders assess regional economic indicators against a backdrop of a dominant greenback.

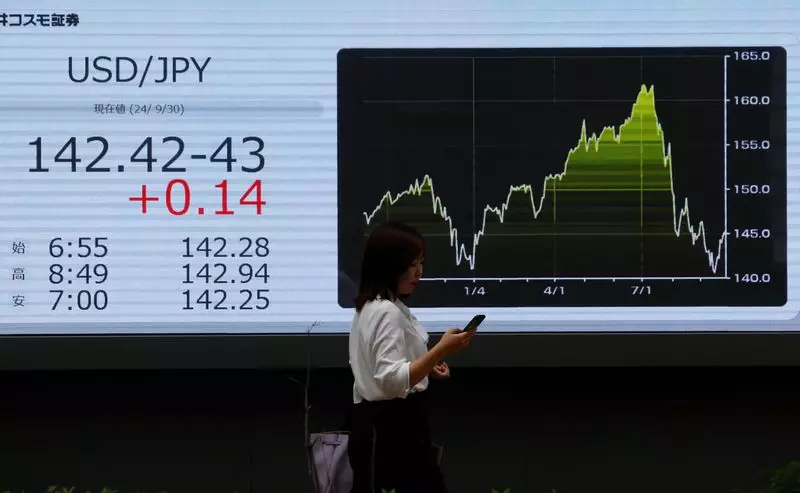

Other currencies, such as the euro and the yen, have also faced headwinds. The euro recently traded at $1.0398, while the Japanese yen approached its five-month lows, last recorded at 157.45 per dollar. Japan’s ongoing efforts to navigate significant budgetary challenges, evidenced by its planned record budget, only add to the complexities influencing the yen’s performance.

Despite underlying geopolitical tensions and fluctuating economic growth rates, Asia-Pacific equity markets have demonstrated an unexpected level of stability. The MSCI Asia-Pacific Index outside Japan has witnessed slight increases, indicating a potential weekly rise of nearly 2%. This trend appears to align with gains in American equity markets, marking high optimism primarily driven by the robust performance of major U.S. indices.

While Japan’s Nikkei has posted a remarkable gain of over 17% this year, traditional powerhouse markets like Hong Kong and China exhibit more nuanced growth. The Shanghai Composite Index and the CSI300 blue-chip index have shown select declines recently; however, both indices are still poised to record annual gains exceeding 10%, bolstered by increased stimulus from Chinese authorities aimed at revitalizing its economy.

Cryptocurrency Volatility and Emerging Trends

In the cryptocurrency market, Bitcoin has experienced fluctuations, trading slightly higher at $98,967 after previously surpassing the $100,000 mark following the Fed’s recent hawkish stance. Developments in global legislation have seen a rise in the use of digital currencies for international transactions, particularly in Russia, as efforts to mitigate Western sanctions gain traction. As international sentiments shift towards digital currencies, monitoring these trends will be essential for understanding future market dynamics.

The commodities sector reflects the dual influences of currency strength and investor sentiment. Brent crude and U.S. crude oil prices have seen slight upticks, indicating a resilient market despite fluctuations in demand and geopolitical uncertainties. Spot gold prices have also increased by 0.5%, trading around $2,626.36 per ounce, showcasing that precious metals continue to attract safe-haven investment amidst currency fluctuations.

As 2023 draws to a close, the financial markets of Asia reflect a combination of cautious optimism and necessary recalibration. With the Fed’s approach to interest rates stirring investor activity and a strong dollar influencing global trading dynamics, stakeholders will need to remain vigilant and adaptable to navigate this complex landscape effectively.