As investors brace themselves for pivotal earnings reports from major corporations, the Asian markets are responding to a delicate mix of geopolitical developments and economic indicators. Recent tensions, particularly between the U.S. and Russia, have injected a level of unease among investors, prompting a dose of caution. However, by the close of the U.S. trading session on Tuesday, the nervousness appeared to wane, allowing for a more optimistic outlook heading into Wednesday’s Asian market activities.

The immediate backdrop is colored by geopolitical tensions escalating around the Ukraine conflict. The Biden administration’s decision to permit Ukraine to utilize U.S.-manufactured weaponry for deep strikes into Russian territory has led to troubling implications. In response, Russian President Vladimir Putin’s remarks about lowering the threshold for nuclear engagement illustrate the heightened risks of miscalculation in this fraught international climate. Such dynamics invoke a sense of alertness among investors, influencing behaviors right across the global markets.

Key Economic Indicators on the Horizon

Investors’ focus on macroeconomic indicators is crucial in forecasting market conditions. Asia’s economic landscape will be impacted by significant data releases including South Korea’s producer price inflation figures and Japan’s trade data, alongside Taiwan’s export orders. The latter, often viewed as a barometer for global demand, is particularly critical since it includes assessments from TSMC—an essential player in the global semiconductor supply chain. Monitoring these factors becomes vital, as they can offer insights into how resilience or vulnerability is shaping economic performance in a post-pandemic landscape.

Moreover, with central bank policies coming under scrutiny, both the People’s Bank of China and Bank Indonesia are set to announce their monetary policy decisions shortly. Market expectations suggest that neither institution will modify interest rates at this juncture, primarily to guard against destabilizing impacts on currency valuations. The PBOC is widely anticipated to maintain its one-year and five-year loan prime rates at 3.10% and 3.60%. Such decisions signal a broader hesitation among Asian central banks to undertake significant policy shifts amidst looming uncertainties, particularly in light of potential protectionist measures from the new U.S. administration.

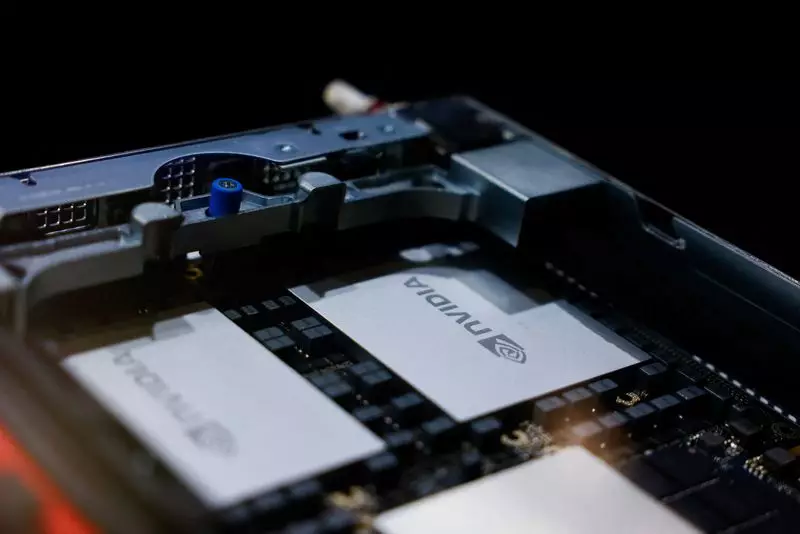

Nvidia’s Earnings and Market Reactions

Taking center stage in the mining of corporate earnings is Nvidia, which is piquing investor interest as analysts anticipate a remarkable surge in revenue. With projections indicating an increase of nearly 83% year-on-year, expectations are set high for the semiconductor giant to not only meet but exceed the consensus estimates projected within the market. Nvidia’s performance is increasingly vital, given its position at the forefront of AI and technology trends, which are driving rapid innovations in various sectors.

Confidence in Nvidia’s ability to deliver robust financial results could directly influence not only the tech sector but the broader market sentiment. A favorable earnings report would likely lead to relief and increased investment flows into Asia, particularly in technology-dependent economies that rely on semiconductor components. Conversely, any sign of underperformance could exacerbate fears regarding a slowing global economy, particularly in light of ongoing U.S.-China trade tensions.

The interplay of geopolitical tumult and economic indicators creates a complex tapestry for investors navigating Asian markets this week. As tensions simmer and serve as a backdrop to pivotal earnings announcements, understanding the broader implications of these developments is crucial. With closely watched data set to emerge, along with significant earnings reports like that of Nvidia, the market will likely swing between caution and optimism.

As participants in the global economy remain vigilant, the balance between risk assessment and opportunity recognition will shape the trajectory of investments moving forward. In a landscape marked by swift changes, resilience and adaptability will be key attributes for market players aiming to thrive amidst uncertainties.