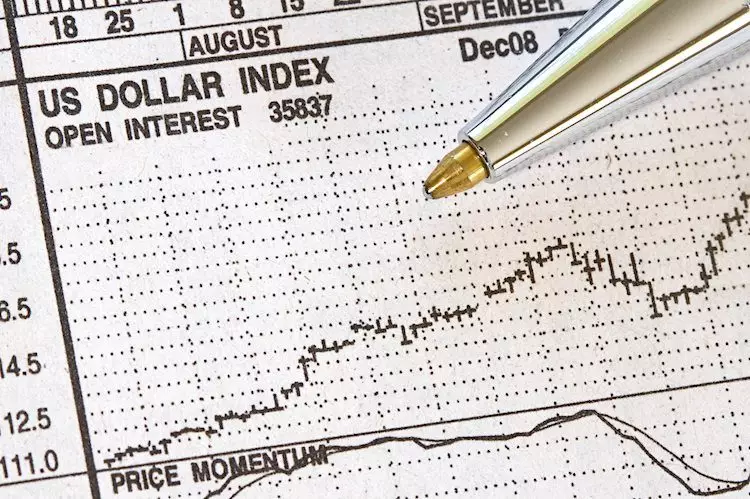

The US Dollar has experienced significant fluctuations in recent trading sessions, with traders responding to a blend of economic data releases and geopolitical developments. On a notable Friday, the Dollar’s momentum faced a noticeable fade after a robust surge earlier in the week. Current market analysts are attributing this shift to renewed stimulus measures from China, including deposit rate cuts aimed at stimulating domestic growth. Furthermore, the US Dollar Index (DXY) has encountered resistance levels close to 104.00, indicating a potential stabilization point before further directional movement.

At 12:30 GMT, the US Census Bureau is scheduled to release critical housing data for September. Analysts predict monthly building permits will slightly reduce to 1.46 million from 1.47 million in August. Housing starts, a vital indicator of economic health, are also expected to decline to 1.35 million from the previous 1.356 million. The implications of these figures could have far-reaching effects on market perceptions of economic trajectory, particularly if they diverge significantly from expectations.

Additionally, the Federal Reserve Bank of Atlanta President Raphael Bostic will address high school students about economic education around 13:30 GMT, a seemingly minor event that underscores ongoing efforts to foster financial literacy among younger generations. Meanwhile, at 14:00 GMT, Minneapolis Fed President Neel Kashkari will moderate a policy panel, and later, Federal Reserve Governor Christopher Waller will discuss decentralized finance at an international economic workshop in Vienna. These events signal an ongoing commitment to open dialogue regarding monetary policy and financial innovation.

The global equity landscape reflects notable trends spurred by Chinese economic policy shifts. Asian indices have shown resilience, with Chinese stocks outperforming others due to an influx of stimulating measures announced by the government. In contrast, European equities are struggling to find footing, particularly after European Central Bank President Christine Lagarde’s comments on the fragile state of the Eurozone economy. Across the pond, US futures are exhibiting a flat trajectory, reflecting investor indecisiveness amid these alternating streams of information.

As we approach the November Federal Reserve meeting, there is strong sentiment in the market, with a staggering 90.2% probability indicating a 25 basis point rate cut. Conversely, expectations of a more aggressive 50 basis point reduction have been effectively dismissed. The market is bracing for potential shifts in monetary policy, especially as the 10-year US Treasury yield hovers around 4.11%.

The technical landscape for the US Dollar Index highlights critical resistance and support levels. Recent data indicates that a resistance band lies around 103.80, closely aligned with the 200-day simple moving average (SMA). Should bullish conditions continue,with notable polling trends suggesting potential political shifts, the DXY may test further resistance at 105.00 and even reach 105.53. Conversely, downward pressure remains mitigated by support at the 100-day SMA, which currently stands at 103.19.

Market analysts are keenly observing indicators like the Relative Strength Index (RSI), which currently suggests that the Index may be overbought, warranting a necessary correction in the near future. Further support is likely to be found at the 55-day SMA, now located at 101.85.

The lessons from the banking crisis experienced in March 2023 remain salient in current market dynamics. The crisis, triggered by significant withdrawals at tech-heavy banks, exposed vulnerabilities within the financial sector that have profoundly influenced investor confidence. Silicon Valley Bank (SVB), a key player in this crisis, was rendered insolvent after realizing significant losses due to the Federal Reserve’s aggressive rate hikes. The aftermath of this episode has shifted expectations regarding future interest rate adjustments.

As the Fed appears poised to pause or reduce the rate of increase, market sentiment may further influence the US Dollar’s value. This evolution has bolstered interest in alternative assets like gold, which has flourished in a declining interest rate environment. The impacts of these systemic instabilities are likely to reverberate throughout the global market landscape, reinforcing the need for careful monitoring of economic indicators and political developments in the lead-up to critical monetary policy decisions.

The current trends surrounding the US Dollar reflect the complexity of economic indicators, geopolitical dynamics, and significant historical events. As traders and investors navigate this landscape, the interplay of robust data releases, Federal Reserve policy shifts, and global economic conditions will continue to shape currency valuations. The US Dollar remains resilient for now, but forthcoming data and market sentiments may prompt necessary recalibrations in strategy as we head into critical trading periods ahead.