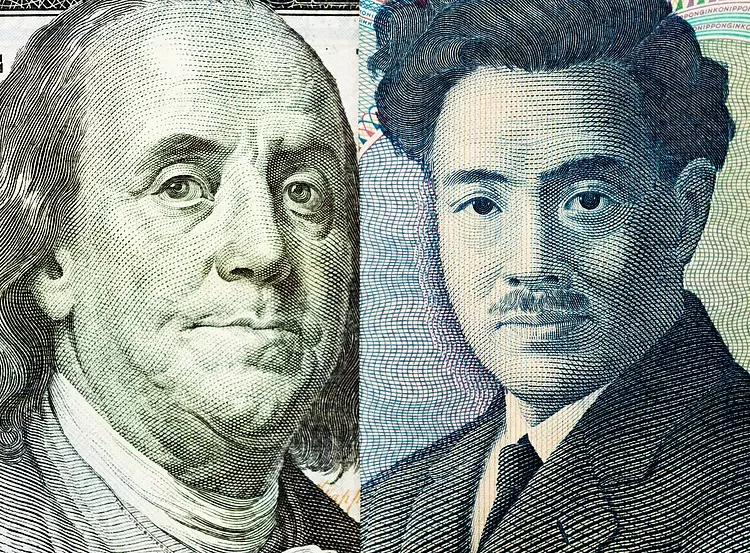

The Japanese Yen (JPY) continues to face challenges as it fails to capitalize on a modest Asian session uptick against the American dollar. Despite a slight increase, the JPY remains within reach of a multi-decade low reached last week, signaling weakness in the currency. The cautious outlook from the Bank of Japan (BoJ), highlighting that monetary policy will remain accommodative for an extended period, is contributing to the JPY’s struggles. Additionally, the ongoing strength of the US Dollar (USD) is further hindering the JPY from making significant gains.

The risk-off sentiment prevalent in the market is providing some support to the safe-haven JPY, which is capping the upside potential for the USD/JPY pair. Japanese officials are also actively verbalizing their support for the domestic currency, aiming to defend its value. Speculations of potential intervention from Japanese authorities to stabilize the JPY are in play, although the BoJ’s conservative stance is acting as a limiting factor for substantial gains. Finance Minister Shunichi Suzuki’s acknowledgment of rapid JPY movements and the possibility of taking appropriate actions against excessive volatility reflect the authorities’ concern.

Recent geopolitical tensions in the Middle East, following reports of Israeli warplanes bombing Iran’s embassy in Syria, have added to the market uncertainty. This has prompted investors to seek refuge in safer assets like the JPY, impacting riskier assets negatively. Moreover, the shift in market expectations regarding a June rate cut by the Federal Reserve after positive US manufacturing data has influenced bond yields and strengthened the USD. Traders are now closely monitoring US economic indicators and speeches from FOMC members for potential trading opportunities.

Analyzing the technical aspects of the USD/JPY pair, the price action has been largely range-bound in recent weeks, suggesting a consolidation phase following a strong rally from the March low. Oscillators on the daily chart indicate a positive momentum, supporting a short-term bullish outlook for the pair. However, a breakout above the multi-decade high around the 152.00 level is crucial for confirming further upside potential. On the downside, a retreat towards the 151.00 mark could present buying opportunities, with initial support near the 150.85-150.80 range. A breach of the psychological 150.00 level may expose the pair to extended corrective declines towards the 149.35-149.30 region.

The Japanese Yen’s struggles persist despite intervention fears and the risk-off sentiment in the market. The BoJ’s dovish stance, coupled with the USD’s strength, continues to weigh on the JPY, limiting its appreciation potential. Traders are advised to monitor geopolitical developments, economic data releases, and technical levels for insights into the future direction of the USD/JPY pair.