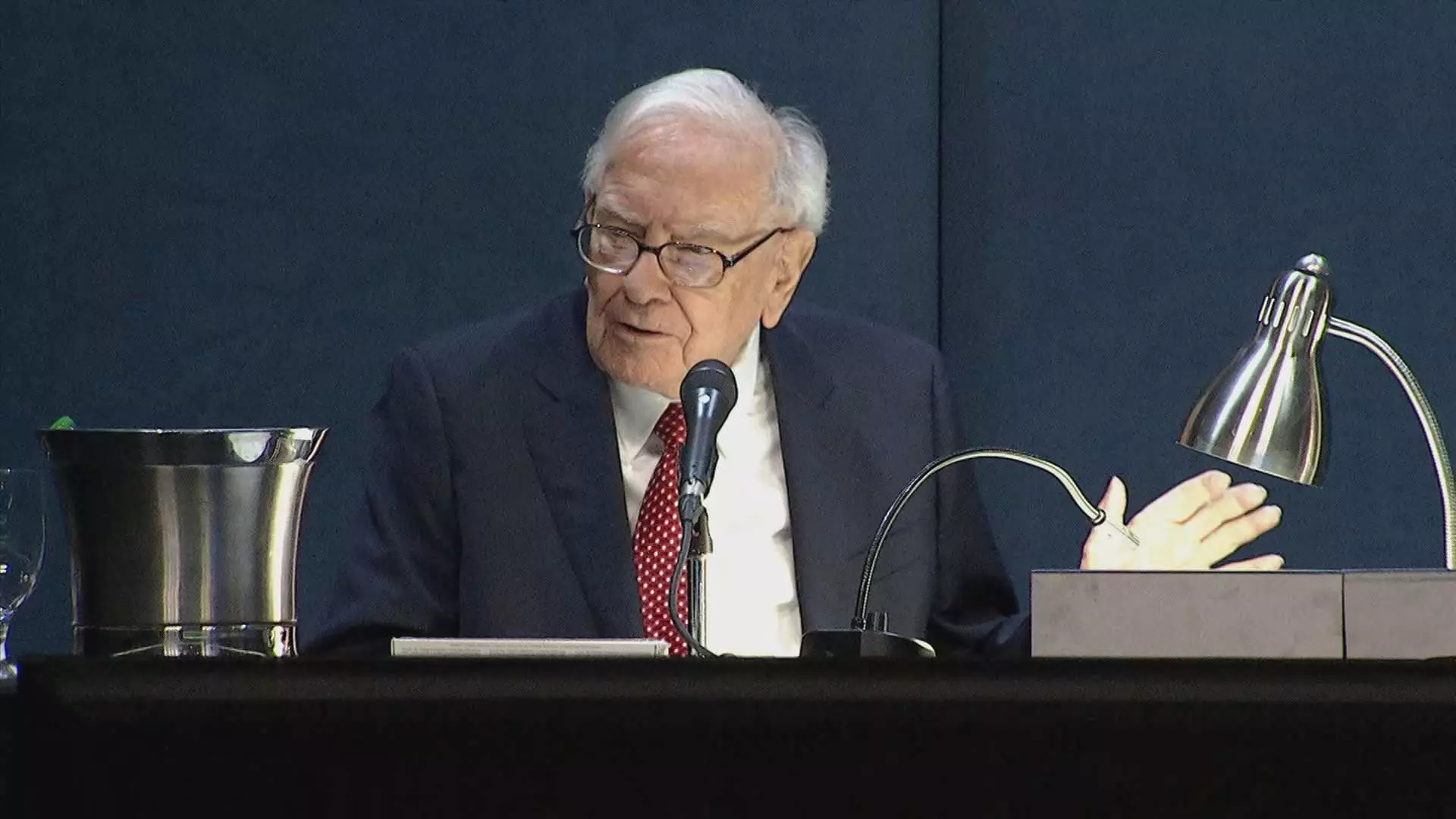

Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has recently made headlines for holding an equal number of shares in Apple and Coca-Cola. This newfound symmetry in his stock portfolio has sparked speculation among investors and analysts alike.

Buffett’s love affair with Coca-Cola dates back to 1988 when he first bought shares in the company. Over the years, he steadily increased his stake, eventually reaching 400 million shares. This round-number share count has remained constant for the past 30 years, solidifying Coca-Cola as one of Buffett’s “permanent” holdings.

Apple: A Surprising Addition

In contrast to his traditional value investing principles, Buffett made a significant investment in Apple, treating it more like a consumer products company than a tech giant. He praised the loyal customer base of the iPhone, even going so far as to call it the second-most important business after Berkshire’s insurers. However, Berkshire’s decision to sell off a large portion of its Apple shares in the second quarter raised eyebrows among investors.

The Equal Stake Phenomenon

The fact that Buffett now holds an equal number of shares in Apple and Coca-Cola has led some to speculate on his future plans for the tech giant. Could this equal stake be a sign of Buffett’s intention to maintain his position in Apple for the long term, much like his unwavering commitment to Coca-Cola? Or is it simply a coincidence that holds no deeper meaning?

While some view Buffett’s equal stake in Apple and Coca-Cola as a strategic move, others believe it to be purely coincidental. Bill Stone, chief investment officer at Glenview Trust Co., doubts that Buffett puts much stock in such numerical symmetry. However, Buffett himself has emphasized the unlimited holding period for both companies, suggesting a long-term commitment to these investments.

In the world of investing, every move made by Warren Buffett is scrutinized and analyzed for potential insights into his strategy. The equal stake in Apple and Coca-Cola is no exception. Whether it was a deliberate decision or a mere coincidence, one thing is clear: Buffett’s investment philosophy remains as strong and steadfast as ever. As the “Oracle of Omaha” continues to make waves in the financial world, investors will be watching closely to see what his next move will be.