Warren Buffett’s Berkshire Hathaway has seen its cash pile swell to a record $276.9 billion last quarter, a significant increase from the previous record of $189 billion set in the first quarter of 2024. This increase came as Buffett sold big chunks of stock holdings, including nearly half of his stake in tech giant Apple. The Oracle of Omaha has been actively selling off stocks for seven consecutive quarters, with a particularly accelerated selling spree in the last period, shedding more than $75 billion in equities in the second quarter alone.

Despite the significant increase in Berkshire’s cash pile and the selling of stock holdings, the conglomerate’s operating earnings showed a positive trend in the second quarter. Operating earnings, which encompass profits from Berkshire’s fully-owned businesses, totaled $11.6 billion in the second quarter, marking a 15% increase from the previous year. This growth was largely driven by the strength in auto insurer Geico, which saw a substantial jump in underwriting earnings before taxes to nearly $1.8 billion in the second quarter, tripling the level from a year ago.

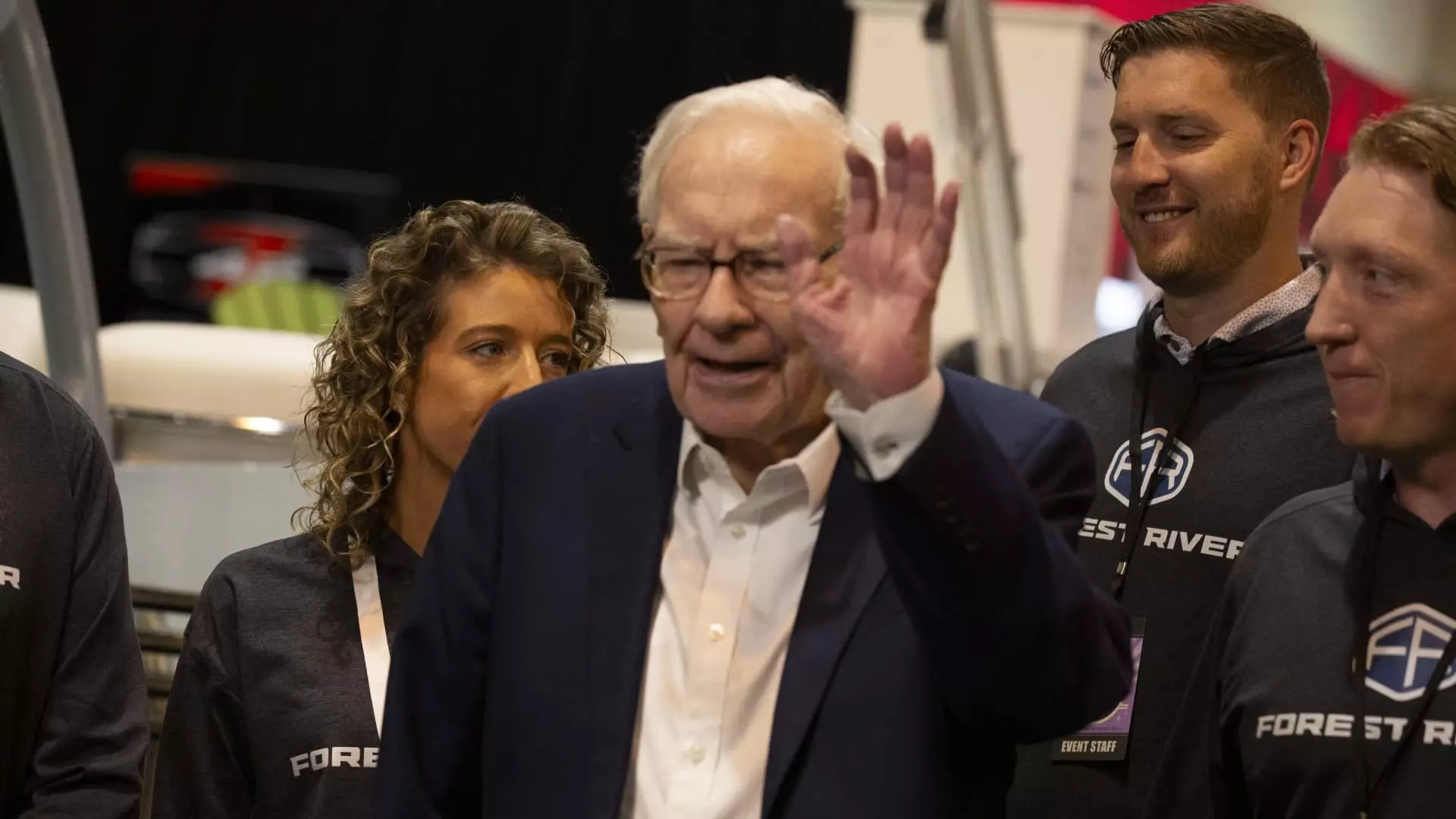

At 94 years old, Warren Buffett expressed his willingness to deploy capital but acknowledged that high prices in the market have given him pause. Despite his desire to invest, Buffett emphasized the importance of finding opportunities with little risk and high return potential. He highlighted that he is not on a “hunger strike” but rather cautious about pursuing investments in an environment where things aren’t as attractive. This sentiment was reflected in Berkshire’s decision to buy back just $345 million worth of its own stock in the second quarter, a significant decrease from the prior two quarters.

The market has experienced significant volatility, with the S&P 500 reaching record levels driven by investor optimism surrounding artificial intelligence innovation in the technology sector. However, concerns about a slowing economy have recently emerged, fueled by weak data such as the disappointing July jobs report. The Dow Jones Industrial Average lost 600 points on a single day, triggering fears of a potential economic downturn. Investors have also raised concerns about valuations in the technology sector, which has been a key driver of the bull market.

Warren Buffett’s Berkshire Hathaway has amassed a record cash pile, reflecting a cautious approach to investments in a high-priced market environment. Despite the challenges posed by market volatility and economic uncertainties, Berkshire’s operating earnings have shown resilience, driven by the performance of its fully-owned businesses. As Buffett continues to navigate the investment landscape, his strategic decisions will be closely watched by investors looking for insights into the future direction of one of the world’s most renowned conglomerates.