The incoming Mexican president, Claudia Sheinbaum, is faced with the daunting challenge of fulfilling her campaign promises to enhance social programs amid a surge in the budget deficit. In his final year in office, President Andres Manuel Lopez Obrador increased spending to complete infrastructure projects and expand welfare programs, leading to a budget deficit of 5.9% of GDP in 2024. This puts pressure on Sheinbaum’s administration to either maintain current spending levels or risk impacting Mexico’s creditworthiness. Economists and analysts suggest that a tax overhaul is necessary to increase government revenue, despite Sheinbaum’s stance against raising taxes.

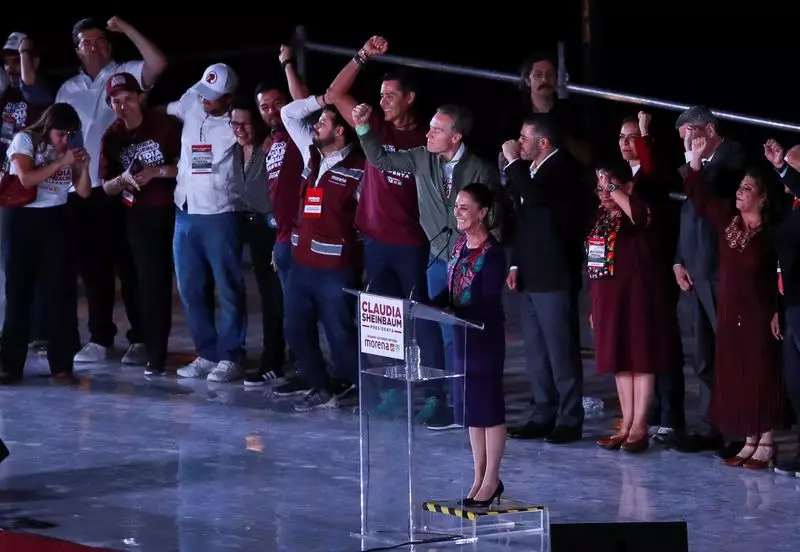

Sheinbaum’s electoral victory was built on a platform of expanding existing social programs and increasing support for vulnerable groups, such as senior citizens and students. While the president-elect has vowed to continue Lopez Obrador’s “republican austerity” policies and maintain fiscal discipline, the cost of pensions, public debt servicing, and government transfers to states pose significant financial challenges. State-owned oil firm Pemex, once a major revenue source, is no longer as profitable, further adding to the fiscal strain.

With Mexico’s public finances under pressure and limited avenues for increasing tax revenue, experts propose various tax reforms to address the budget shortfall. Suggestions include revising property and vehicle taxes, adjusting corporate profit taxes, implementing “green taxes,” and considering royalties on state-owned enterprises. Despite Sheinbaum’s reluctance to implement a comprehensive tax reform, the current economic forecast of modest GDP growth does not provide significant relief. If Mexico hopes to finance its social programs and address its budgetary challenges, alternative revenue sources must be explored.

Recent fiscal reforms in Mexico, such as tax increases on high earners and new levies on specific goods, have had mixed success in boosting revenue. While efforts to combat tax evasion and resolve disputes with large corporations resulted in higher tax collection, these strategies may not be sustainable in the long term. Mexico’s tax revenue remains significantly below the OECD average, highlighting the need for comprehensive reform to increase the tax-to-GDP ratio. As the country grapples with a widening budget deficit and sluggish economic growth, Sheinbaum’s administration must seek innovative solutions to address Mexico’s fiscal challenges.

Mexico’s new president faces a complex set of obstacles, including a ballooning budget deficit, limited revenue sources, and growing demands for social programs. While the path forward may not be straightforward, Sheinbaum’s willingness to explore tax reform and improve fiscal management will be crucial in navigating these challenges. With careful planning and strategic decision-making, Mexico can work towards sustainable economic growth and financial stability in the years to come.