In the realm of monetary policy, central banks play a pivotal role in shaping economic landscapes. Most recently, policymakers across major economies have opted for a cautious approach towards monetary easing. The implications of this strategy have reverberated through Asian share markets, creating a wave of uncertainty among investors.

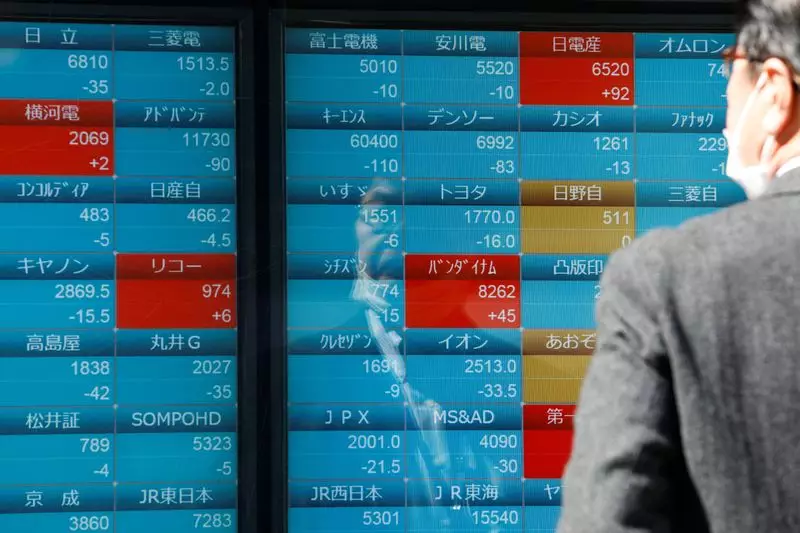

The repercussions of central bank decisions were immediately felt in key Asian share benchmarks. MSCI’s broadest index of Asia-Pacific shares outside Japan saw a decline of 0.57%, reflecting the cautious sentiment prevalent in the region. Australia’s S&P/ASX 200 index, one of the prominent decliners, plummeted by 0.8%, exacerbated by a pullback in commodity prices.

Geopolitical tensions added another layer of unease as China’s military conducted “punishment” drills near Taiwan shortly after President Lai Ching-te assumed office. Despite these geopolitical maneuvers, Taiwan’s stock market remained resilient, showcasing a slight increase of 0.3%.

The release of hawkish minutes from the Federal Reserve’s recent policy meeting, coupled with a surge in UK inflation figures, has prompted investors to recalibrate their expectations regarding future rate cuts. Uncertainty looms large, both from a policy and market standpoint, as central banks grapple with questions surrounding interest rates and inflation.

In the US, futures received an initial boost following Nvidia’s optimistic revenue forecast, with shares surging by 5.9% in extended trade. The S&P 500 and Nasdaq futures exhibited gains, signaling a positive trajectory for the American markets. Japan’s Nikkei also experienced a rise of 0.6%, supported by a weaker yen.

Across the pond, Britain and New Zealand delivered contrasting views on inflation and monetary policy. While UK inflation figures remained stubbornly high, the Bank of England’s rate cut expectations waned. In New Zealand, the Reserve Bank provided a stark assessment, hinting at a prolonged timeline for rate cuts, much to the surprise of markets.

Market Dynamics and Commodities

Looking beyond equities, the impact of central bank decisions extended to commodities. Gold witnessed a marginal decline, veering away from its recent record highs. Oil prices also experienced a downturn, with Brent crude and US crude registering losses as the specter of higher US rates loomed.

In Asia, Hong Kong’s Hang Seng Index encountered profit-taking, resulting in a 1.5% slump from its recent highs. Similarly, China’s blue-chip index faced a dip of 0.3%, aligning with the broader cautious sentiment prevalent across the region.

As central banks navigate the complex terrain of monetary policy, their decisions cast a shadow on global financial markets. The cautious stance adopted by policymakers has sent ripples through Asian markets, with investors treading cautiously amidst uncertainty. The interplay of geopolitical tensions, inflation figures, and market dynamics underscores the intricate dance between central bank decisions and market reactions. In an ever-evolving landscape, vigilance and adaptability remain critical for investors navigating the tumultuous waters of global finance.